Neiman Marcus 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The net assets of Gurwitch Products, L.L.C. were sold for their net carrying value (after purchase accounting adjustments made in

connection with the Acquisition to state such assets at fair value).

In February 1999, NMG acquired a 56% controlling interest in Kate Spade LLC, a designer and marketer of high-end

accessories. In April 2005, the minority investor in Kate Spade LLC exercised the put option with respect to the sale of the full

amount of its 44% stake in such company to NMG. In October 2006, we entered into an agreement to settle the put option whereby we

purchased the interest held by the minority investor for approximately $59.4 million.

In November 2006, we entered into a definitive agreement to sell 100% of the ownership interests in Kate Spade LLC to Liz

Claiborne, Inc. (consisting of both our original 56% interest and the 44% minority interest subsequently purchased by NMG) for

pretax net cash proceeds of approximately $121.5 million. Both the purchase of the minority interest in Kate Spade LLC and the sale of

Kate Spade LLC to Liz Claiborne, Inc. were consummated in December 2006.

The Company's consolidated financial statements, accompanying notes and other information provided in this Annual Report on

Form 10-K reflect Gurwitch Products, L.L.C. and Kate Spade LLC as discontinued operations for all periods presented.

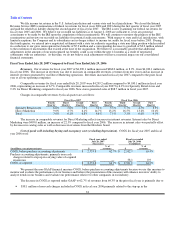

Recent Developments

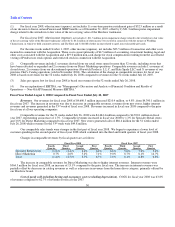

On September 4, 2008, we announced preliminary total revenues and comparable revenues of approximately $285 million and

$281 million, respectively, for the four-week August period of fiscal year 2009. In the four-week August period, total revenues increased

0.7% and comparable revenues decreased 0.5% compared to the four-week August period of fiscal year 2008. Comparable revenues

decreased 0.4% in our Specialty Retail stores and 1.1% in Direct Marketing for the four-week August period of fiscal year 2009.

All the financial data set forth above for the four-week August period of fiscal year 2009 are preliminary and unaudited and

subject to revision based upon our review and a review by our independent registered public accounting firm of our financial condition

and results of operations for the quarter ending November 1, 2008. Once we and our independent registered public accounting firm have

completed our respective reviews of our financial information for the quarter ending November 1, 2008, we may report financial results

that are different from those set forth above.

Factors Affecting Our Results

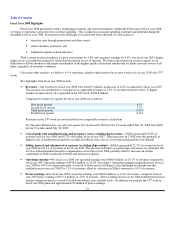

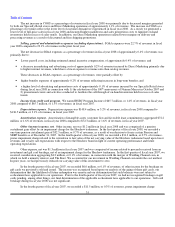

Revenues. We generate our revenues from the sale of high-end merchandise through our Specialty Retail stores and Direct

Marketing operations. Components of our revenues include:

• Sales of merchandise—Revenues from our Specialty Retail stores are recognized at the later of the point of sale or the

delivery of goods to the customer. Revenues from our Direct Marketing operations are recognized when the merchandise is

delivered to the customer. We maintain reserves for anticipated sales returns primarily based on our historical trends related

to returns by both our retail and direct marketing customers. Revenues exclude sales taxes collected from our customers.

• Delivery and processing—We generate revenues from delivery and processing charges related to merchandise delivered to

our customers from both our retail and direct marketing operations.

Our revenues can be affected by the following factors:

• changes in the level of consumer spending generally and, specifically, on luxury goods;

• changes in the level of full-price sales;

• changes in the level of promotional events conducted by our Specialty Retail stores and Direct Marketing operations;

• our ability to successfully implement our store expansion and remodeling strategies;

• the rate of growth in internet revenues by our Direct Marketing operations; and

23