Neiman Marcus 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

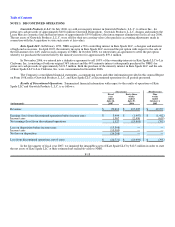

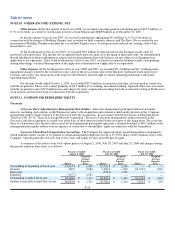

NOTE 4. TRANSACTIONS WITH SPONSORS

In connection with the Acquisition, we entered into a management services agreement with affiliates of the Sponsors

pursuant to which affiliates of one of the Sponsors received on the closing date a transaction fee of $25 million in cash. Affiliates of

the other Sponsor waived any cash transaction fee in connection with the Acquisition.

In addition, pursuant to such agreement, and in exchange for on-going consulting and management advisory services that

will be provided to us by the Sponsors and their affiliates, affiliates of the Sponsors receive an aggregate annual management fee equal

to the lesser of (i) 0.25% of our consolidated annual revenues or (ii) $10 million. Affiliates of the Sponsors also receive

reimbursement for out-of-pocket expenses incurred by them or their affiliates in connection with services provided pursuant to the

agreement. These management fees are payable quarterly in arrears. We recorded management fees of $10.0 million during fiscal

years 2008 and 2007 and $8.7 million during the forty-three weeks ended July 29, 2006, which are included in selling, general and

administrative expenses in the consolidated statements of earnings.

The management services agreement also provides that affiliates of the Sponsors may receive future fees in connection with

certain subsequent financing and acquisition or disposition transactions. The management services agreement includes customary

exculpation and indemnification provisions in favor of the Sponsors and their affiliates.

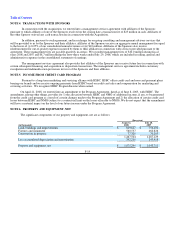

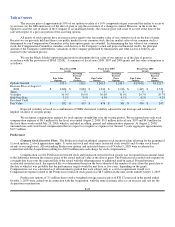

NOTE 5. INCOME FROM CREDIT CARD PROGRAM

Pursuant to a long-term marketing and servicing alliance with HSBC, HSBC offers credit card and non-card payment plans

bearing our brands and we receive ongoing payments from HSBC based on credit card sales and compensation for marketing and

servicing activities. We recognize HSBC Program Income when earned.

On April 21, 2008, we entered into an amendment to the Program Agreement, dated as of June 8, 2005, with HSBC. The

amendment, among other things, provides for 1) the allocation between HSBC and NMG of additional income, if any, to be generated

from the credit card program as a result of certain changes made to the Program Agreement and 2) the allocation of certain credit card

losses between HSBC and NMG (subject to a contractual limit on the losses allocable to NMG). We do not expect that the amendment

will have a material impact on the level of our future income under the Program Agreement.

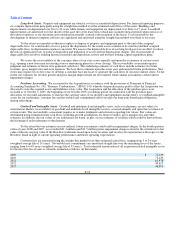

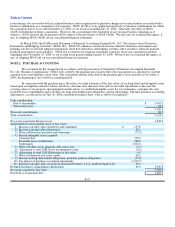

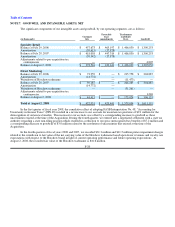

NOTE 6. PROPERTY AND EQUIPMENT, NET

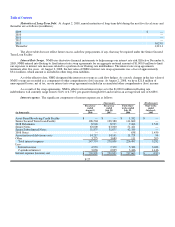

The significant components of our property and equipment, net are as follows:

(Successor)

(in thousands)

August 2,

2008

July 28,

2007

Land, buildings and improvements $ 829,647 $ 756,100

Fixtures and equipment 560,537 460,826

Construction in progress 77,320 70,203

1,467,504 1,287,129

Less accumulated depreciation and amortization 392,210 243,418

Property and equipment, net $ 1,075,294 $ 1,043,711

F-19