Lexmark 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

distributor, reseller and OEM customer trade receivable balances collectively represented $281 million or

approximately 46% of total trade receivables at December 31, 2007, and $259 million or approximately

42% of total trade receivables at December 31, 2006, of which Dell receivables were $207 million or

approximately 34% of total trade receivables at December 31, 2007, and $170 million or approximately

27% of total trade receivables at December 31, 2006. However, Lexmark performs ongoing credit

evaluations of the financial position of its third-party distributors, resellers and other customers to

determine appropriate credit limits.

Lexmark generally has experienced longer accounts receivable cycles in its emerging markets, in

particular, Latin America, when compared to its U.S. and European markets. In the event that

accounts receivable cycles in these developing markets lengthen further, the Company could be

adversely affected.

Lexmark also procures a wide variety of components used in the manufacturing process. Although many of

these components are available from multiple sources, the Company often utilizes preferred supplier

relationships to better ensure more consistent quality, cost and delivery. The Company also sources some

printer engines and finished products from OEMs. Typically, these preferred suppliers maintain alternate

processes and/or facilities to ensure continuity of supply. Although Lexmark plans in anticipation of its

future requirements, should these components not be available from any one of these suppliers, there can

be no assurance that production of certain of the Company’s products would not be disrupted.

16. COMMITMENTS AND CONTINGENCIES

Commitments

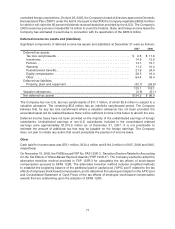

Lexmark is committed under operating leases (containing various renewal options) for rental of office and

manufacturing space and equipment. Rent expense (net of rental income) was $55.1 million, $49.9 million

and $52.0 million in 2007, 2006 and 2005, respectively. Future minimum rentals under terms of non-

cancelable operating leases (net of sublease rental income commitments) as of December 31, 2007, were

as follows:

2008 2009 2010 2011 2012 Thereafter

Minimum lease payments (net of sublease

rental income) . . . . . . . . . . . . . . . . . . . . . $38.1 $26.5 $19.0 $12.7 $10.2 $8.0

Contingencies

In accordance with SFAS No. 5, Accounting for Contingencies, Lexmark records a provision for a loss

contingency when management believes that it is both probable that a liability has been incurred and the

amount of loss can be reasonably estimated. The Company believes it has adequate provisions for any

such matters.

Legal proceedings

On December 30, 2002 (“02 action”) and March 16, 2004 (“04 action”), the Company filed claims against

Static Control Components, Inc. (“SCC”) in the U.S. District Court for the Eastern District of Kentucky (the

“District Court”) alleging violation of the Company’s intellectual property and state law rights. At various

times in 2004, Pendl Companies, Inc. (“Pendl”), Wazana Brothers International, Inc. (“Wazana”) and NER

Data Products, Inc. (“NER”), were added as additional defendants to the claims brought by the Company in

the 02 action and/or the 04 action. The Company entered into separate settlement agreements with each

of NER, Pendl and Wazana pursuant to which the Company released each party, and each party released

the Company, from any and all claims, and at various times in May 2007 the District Court entered orders

dismissing with prejudice all such litigation. Similar claims in a separate action were filed by the Company

in the District Court against David Abraham and Clarity Imaging Technologies, Inc. (“Clarity”) on October 8,

2004. SCC and Clarity have filed counterclaims against the Company in the District Court alleging that the

Company engaged in anti-competitive and monopolistic conduct and unfair and deceptive trade practices

87