Lexmark 2007 Annual Report Download - page 56

Download and view the complete annual report

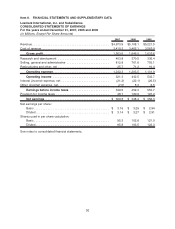

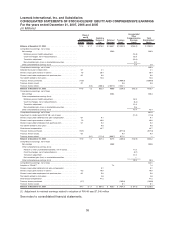

Please find page 56 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL EXPENDITURES

Capital expenditures totaled $183 million, $200 million and $201 million in 2007, 2006 and 2005,

respectively. The capital expenditures in 2007 were attributable to new product development,

infrastructure support and manufacturing capacity expansion. During 2008, the Company expects

capital expenditures to be approximately $225 million, primarily attributable to new product

development, infrastructure support and manufacturing capacity expansion. The capital expenditures

are expected to be funded through cash from operations.

EFFECT OF CURRENCY EXCHANGE RATES AND EXCHANGE RATE RISK MANAGEMENT

Revenue derived from international sales, including exports from the U.S., accounts for approximately

57% of the Company’s consolidated revenue, with Europe accounting for approximately two-thirds of

international sales. Substantially all foreign subsidiaries maintain their accounting records in their local

currencies. Consequently, period-to-period comparability of results of operations is affected by fluctuations

in currency exchange rates. Certain of the Company’s Latin American and European entities use the

U.S. dollar as their functional currency.

Currency exchange rates had a material favorable impact on international revenue in 2007. In 2006 and

2005, currency exchange rates did not have a material impact on international revenue. The Company acts

to neutralize the effects of exchange rate fluctuations through the use of operational hedges, such as

pricing actions and product sourcing decisions.

The Company’s exposure to exchange rate fluctuations generally cannot be minimized solely through the

use of operational hedges. Therefore, the Company utilizes financial instruments, from time to time, such

as forward exchange contracts and currency options to reduce the impact of exchange rate fluctuations on

actual and anticipated cash flow exposures and certain assets and liabilities, which arise from transactions

denominated in currencies other than the functional currency. The Company does not purchase currency-

related financial instruments for purposes other than exchange rate risk management.

RECENT ACCOUNTING PRONOUNCEMENTS

Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for a description of recent

accounting pronouncements which is incorporated herein by reference.

INFLATION

The Company is subject to the effects of changing prices and operates in an industry where product prices

are very competitive and subject to downward price pressures. As a result, future increases in production

costs or raw material prices could have an adverse effect on the Company’s business. In an effort to

minimize the impact on earnings of any such increases, the Company must continually manage its product

costs and manufacturing processes.

50