Lexmark 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

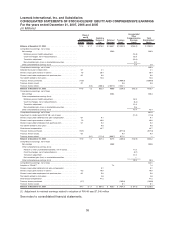

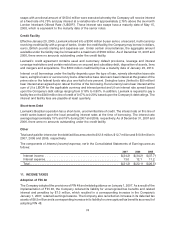

The following table presents a rollforward of the liability incurred for employee termination benefits in

connection with the 2007 Restructuring Plan. The liability is included in Accrued liabilities on the

Company’s Consolidated Statements of Financial Position.

Employee

Termination

Benefits

Balance at January 1, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ —

Costs incurred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.7

Payments & other

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.6)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $21.1

(1)

Other consists of pension related items that will be settled through the Company’s pension plans.

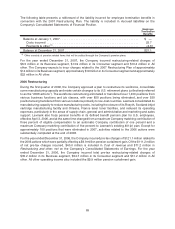

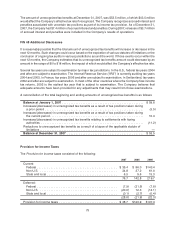

For the year ended December 31, 2007, the Company incurred restructuring-related charges of

$6.5 million in its Business segment, $13.9 million in its Consumer segment and $10.4 million in All

other. The Company expects to incur charges related to the 2007 Restructuring Plan of approximately

$14 million in its Business segment, approximately $19 million in its Consumer segment and approximately

$22 million in All other.

2006 Restructuring

During the first quarter of 2006, the Company approved a plan to restructure its workforce, consolidate

some manufacturing capacity and make certain changes to its U.S. retirement plans (collectively referred

to as the “2006 actions”). The workforce restructuring eliminated or transferred over 1,400 positions from

various business functions and job classes, with over 850 positions being eliminated, and over 550

positions being transferred from various locations primarily to low-cost countries. Lexmark consolidated its

manufacturing capacity to reduce manufacturing costs, including the closure of its Rosyth, Scotland inkjet

cartridge manufacturing facility and Orleans, France laser toner facilities, and reduced its operating

expenses, particularly in the areas of supply chain, general and administrative and marketing and sales

support. Lexmark also froze pension benefits in its defined benefit pension plan for U.S. employees,

effective April 3, 2006, and at the same time changed from a maximum Company matching contribution of

three percent of eligible compensation to an automatic Company contribution of one percent and a

maximum Company matching contribution of five percent to Lexmark’s existing 401(k) plan. Except for

approximately 100 positions that were eliminated in 2007, activities related to the 2006 actions were

substantially completed at the end of 2006.

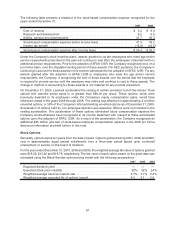

For the year ended December 31, 2006, the Company incurred pre-tax charges of $121.1 million related to

the 2006 actions which were partially offset by a $9.9 million pension curtailment gain. Of the $111.2 million

of net pre-tax charges incurred, $40.0 million is included in Cost of revenue and $71.2 million in

Restructuring and other, net on the Company’s Consolidated Statements of Earnings. For the year

ended December 31, 2006, the Company incurred total pre-tax restructuring-related charges of

$35.2 million in its Business segment, $54.7 million in its Consumer segment and $31.2 million in All

other. All other operating income also included the $9.9 million pension curtailment gain.

65