Lexmark 2007 Annual Report Download - page 35

Download and view the complete annual report

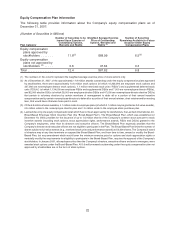

Please find page 35 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.calculated in accordance with the original provisions of SFAS No. 123, Accounting for Stock-Based

Compensation. The fair value of the Company’s stock-based awards, less estimated forfeitures, is

amortized over the awards’ vesting periods on a straight-line basis.

Prior to the adoption of SFAS 123R on January 1, 2006, the Company accounted for the costs of its stock-

based employee compensation plans under Accounting Principles Board (“APB”) Opinion No. 25,

Accounting for Stock Issued to Employees (“APB 25”), and related interpretations. Under APB 25,

compensation cost was not recognized for substantially all options granted because the exercise price

was at least equal to the market value of the underlying common stock on the date of grant.

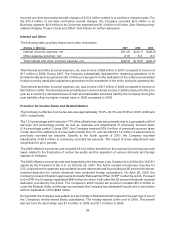

The fair value of each option award on the grant date was estimated using the Black-Scholes option-pricing

model with the following assumptions: expected dividend yield, expected stock price volatility, weighted

average risk-free interest rate and weighted average expected life of the options. Under SFAS 123R, the

Company’s expected volatility assumption used in the Black-Scholes option-pricing model was based

exclusively on historical volatility and the expected life assumption was established based upon an

analysis of historical option exercise behavior. The risk-free interest rate used in the Black-Scholes model

was based on the implied yield currently available on U.S. Treasury zero-coupon issues with a remaining

term equal to the Company’s expected term assumption. The Company has never declared or paid any

cash dividends on the Class A Common Stock and has no current plans to pay cash dividends on the

Class A Common Stock. The payment of any future cash dividends will be determined by the Company’s

board of directors in light of conditions then existing, including the Company’s earnings, financial condition

and capital requirements, restrictions in financing agreements, business conditions, tax laws, certain

corporate law requirements and various other factors.

Restructuring

Lexmark records a liability for a cost associated with an exit or disposal activity at its fair value in the period

in which the liability is incurred, except for liabilities for certain employee termination benefit charges that

are accrued over time. Employee termination benefits associated with an exit or disposal activity are

accrued when the obligation is probable and estimable as a postemployment benefit obligation when local

statutory requirements stipulate minimum involuntary termination benefits or, in the absence of local

statutory requirements, termination benefits to be provided are similar to benefits provided in prior

restructuring activities. Specifically for termination benefits under a one-time benefit arrangement, the

timing of recognition and related measurement of a liability depends on whether employees are required to

render service until they are terminated in order to receive the termination benefits and, if so, whether

employees will be retained to render service beyond a minimum retention period. For employees who are

not required to render service until they are terminated in order to receive the termination benefits or

employees who will not provide service beyond the minimum retention period, the Company records a

liability for the termination benefits at the communication date. If employees are required to render service

until they are terminated in order to receive the termination benefits and will be retained to render service

beyond the minimum retention period, the Company measures the liability for termination benefits at the

communication date and recognizes the expense and liability ratably over the future service period. For

contract termination costs, Lexmark records a liability for costs to terminate a contract before the end of its

term when the Company terminates the agreement in accordance with the contract terms or when the

Company ceases using the rights conveyed by the contract. The Company records a liability for other costs

associated with an exit or disposal activity in the period in which the liability is incurred. Once Company

management approves an exit or disposal activity, the Company closely monitors the expenses that are

reported in association with the activity.

Warranty

Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The

amounts accrued for product warranties is based on the quantity of units sold under warranty, estimated

product failure rates, and material usage and service delivery costs. The estimates for product failure rates

and material usage and service delivery costs are periodically adjusted based on actual results. For

29