Lexmark 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

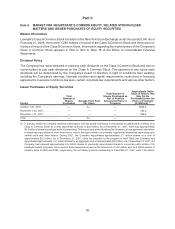

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Lexmark’s Class A Common Stock is traded on the New York Stock Exchange under the symbol LXK. As of

February 21, 2008, there were 1,240 holders of record of the Class A Common Stock and there were no

holders of record of the Class B Common Stock. Information regarding the market prices of the Company’s

Class A Common Stock appears in Part II, Item 8, Note 18 of the Notes to Consolidated Financial

Statements.

Dividend Policy

The Company has never declared or paid any cash dividends on the Class A Common Stock and has no

current plans to pay cash dividends on the Class A Common Stock. The payment of any future cash

dividends will be determined by the Company’s board of directors in light of conditions then existing,

including the Company’s earnings, financial condition and capital requirements, restrictions in financing

agreements, business conditions, tax laws, certain corporate law requirements and various other factors.

Issuer Purchases of Equity Securities

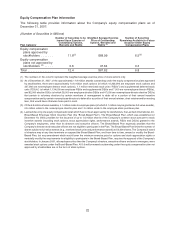

Period

Total

Number of

Shares

Purchased

Average Price Paid

Per Share

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

Approximate Dollar

Value of Shares That

May Yet Be

Purchased Under the

Plans or Programs

(In Millions)

(1)

October 1-31, 2007 . . . . . . . . . . . . . — $— — $295.5

November 1-30, 2007 . . . . . . . . . . . — — — 295.5

December 1-31, 2007 . . . . . . . . . . . — — — 295.5

Total . . . . . . . . . . . . . . . . . . . . . . . — $— —

(1) In January 2006, the Company received authorization from the board of directors to repurchase an additional $1.0 billion of its

Class A Common Stock for a total repurchase authority of $3.9 billion. As of December 31, 2007, there was approximately

$0.3 billion of share repurchase authority remaining. This repurchase authority allows the Company, at management’s discretion,

to selectively repurchase its stock from time to time in the open market or in privately negotiated transactions depending upon

market price and other factors. During 2007, the Company repurchased approximately 2.7 million shares at a cost of

approximately $0.2 billion. As of December 31, 2007, since the inception of the program in April 1996, the Company had

repurchased approximately 74.1 million shares for an aggregate cost of approximately $3.6 billion. As of December 31, 2007, the

Company had reissued approximately 0.5 million shares of previously repurchased shares in connection with certain of its

employee benefit programs. As a result of these issuances as well as the retirement of 44.0 million and 16.0 million shares of

treasury stock in 2005 and 2006, respectively, the net treasury shares outstanding at December 31, 2007, were 13.6 million.

20