Lexmark 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognized or disclosed at fair value in the financial statements on a nonrecurring basis. The Company is

currently evaluating the provisions of SFAS 157.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Liabilities (“SFAS 159”). SFAS 159 provides entities with the option to report selected financial assets and

liabilities at fair value. Business entities adopting SFAS 159 will report unrealized gains and losses in

earnings at each subsequent reporting date on items for which the fair value option has been elected.

SFAS 159 establishes presentation and disclosure requirements designed to facilitate comparisons

between entities that choose different measurement attributes for similar types of assets and liabilities.

SFAS 159 requires additional information that will help investors and other financial statement users to

understand the effect of an entity’s choice to use fair value on its earnings. SFAS 159 is effective for fiscal

years beginning after November 15, 2007, with earlier adoption permitted. The Company is currently

evaluating the impact of SFAS 159.

In June 2007, the FASB reached consensus on Emerging Issues Task Force (“EITF”) Issue No. 07-03,

Accounting for Nonrefundable Advance Payments for Goods or Services Received for Use in Future

Research and Development Activities (“EITF 07-03”). EITF 07-03 concludes that nonrefundable advance

payments for goods or services that will be used for or rendered for future research and development

activities should be deferred and capitalized. The capitalized payment should be charged to expense once

the goods are delivered or services performed or at such time that the entity no longer expects goods to be

delivered or services to be performed. EITF 07-03 is effective for fiscal years beginning after December 15,

2007, and should be applied prospectively for new contracts entered into on or after the effective date. The

provisions of EITF 07-03 will not materially impact the Company’s financial position, results of operations

and cash flows upon adoption.

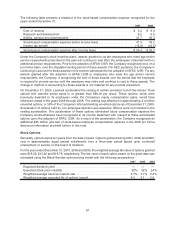

In December 2007, the SEC issued Staff Accounting Bulletin (“SAB”) No. 110, Certain Assumptions Used

in Valuation Methods (“SAB 110”), expressing the staff’s consent to continue to accept, under certain

circumstances, the use of a “simplified” method in developing an estimate of the expected term of “plain

vanilla” share options as previously discussed in SAB 107. Companies having sufficient historical share

option exercise experience may not apply the simplified method. Because Lexmark’s expected term

assumption was based upon an analysis of historical option exercise behavior, SAB 110 will have no

impact to the Company’s financial position, results of operations and cash flows.

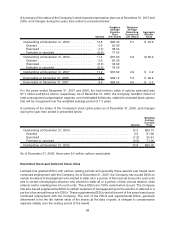

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations

(“SFAS 141R”), replacing SFAS No. 141, Business Combinations (“SFAS 141”). SFAS 141R retains

the fundamental requirements of purchase method accounting for acquisitions as set forth previously in

SFAS 141. However, this statement defines the acquirer as the entity that obtains control of a business in

the business combination, thus broadening the scope of SFAS 141 which applied only to business

combinations in which control was obtained through transfer of consideration. SFAS 141R also requires

several changes in the way assets and liabilities are recognized and measured in purchase accounting

including expensing acquisition-related costs as incurred, recognizing assets and liabilities arising from

contractual contingencies at the acquisition date, and capitalizing in-process research and development.

SFAS 141R also requires the acquirer to recognize a gain in earnings for bargain purchases, or the excess

of the fair value of net assets over the consideration transferred plus any noncontrolling interest in the

acquiree, a departure from the concept of “negative goodwill” previously recognized under SFAS 141.

SFAS 141R is effective for the Company beginning January 1, 2009, and will apply prospectively to

business combinations completed on or after that date.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial

Statements, an amendment of ARB 51 (“SFAS 160”). SFAS 160 applies to all companies that prepare

consolidated financial statements but will only affect companies that have a noncontrolling interest in a

subsidiary or that deconsolidate a subsidiary. SFAS 160 clarifies that noncontrolling interests be reported

as a component separate from the parent’s equity and that changes in the parent’s ownership interest in a

subsidiary be recorded as equity transactions if the parent retains its controlling interest in the subsidiary.

The statement also requires consolidated net income to include amounts attributable to both the parent

63