Lexmark 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

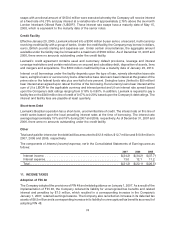

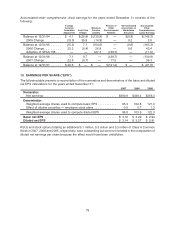

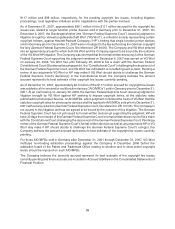

The adoption of SFAS 158 in 2006 did not have a material impact on the Company’s results of operations

and cash flows. The following table illustrates the incremental effect of applying SFAS 158 on individual line

items on the Consolidated Statement of Financial Position as of December 31, 2006:

Before

SFAS 158

Adjustment After

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 338.7 $(166.5) $ 172.2

Accrued liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 719.1 4.6 723.7

Other noncurrent liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500.1 (160.1) 340.0

Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . (119.9) (11.0) (130.9)

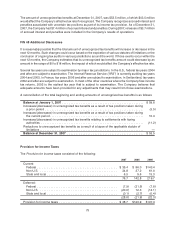

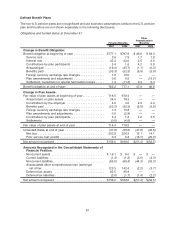

The accumulated benefit obligation for all of the Company’s defined benefit pension plans was

$756.0 million and $771.4 million at December 31, 2007 and 2006, respectively.

Pension plans with a benefit obligation in excess of plan assets at December 31:

Benefit

Obligation

Plan

Assets

Benefit

Obligation

Plan

Assets

2007 2006

Plans with projected benefit obligation in excess of

plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $664.6 $597.7 $673.9 $606.2

Plans with accumulated benefit obligation in excess of

plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 659.9 597.5 665.3 601.7

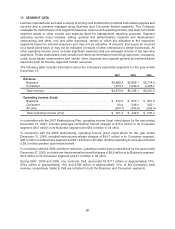

Components of net periodic benefit cost:

2007 2006 2005 2007 2006 2005

Pension Benefits

Other Postretirement

Benefits

Net Periodic Benefit Cost:

Service cost . . . . . . . . . . . . . . . . . . . . . . . $ 2.6 $ 7.9 $ 16.9 $ 1.7 $ 1.8 $ 1.8

Interest cost . . . . . . . . . . . . . . . . . . . . . . . 42.3 42.0 41.9 2.5 2.5 3.1

Expected return on plan assets . . . . . . . . (48.8) (49.2) (51.2) — — —

Amortization of prior service cost

(credit) . . . . . . . . . . . . . . . . . . . . . . . . . — — (1.3) (4.0) (3.8) (1.8)

Amortization of net loss . . . . . . . . . . . . . . 15.1 17.2 16.4 0.9 1.0 0.9

Settlement, curtailment or special

termination (gains) losses . . . . . . . . . . . 2.0 (5.4) 3.4 0.1 (0.1) 0.1

Net periodic benefit cost . . . . . . . . . . . . . . . $ 13.2 $ 12.5 $ 26.1 $ 1.2 $ 1.4 $ 4.1

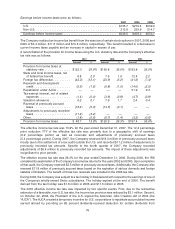

Other changes in plan assets and benefit obligations recognized in accumulated other comprehensive

income (“AOCI”) (pre-tax) for the year ended December 31, 2007:

Pension

Benefits

Other

Postretirement

Benefits

Net (gain) arising during the period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (8.1) $(1.1)

Effect of foreign currency exchange rate changes on amounts included

inAOCI................................................ 0.6 —

Less amounts recognized as a component of net periodic benefit cost:

Amortization of net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15.1) (0.9)

Amortization or curtailment recognition of prior service cost (credit) . . . — 4.3

Total amount recognized in AOCI for the period . . . . . . . . . . . . . . . . . . . (22.6) 2.3

Total amount recognized in net periodic benefit cost and AOCI for the

period................................................. $ (9.4) $3.5

82