Lexmark 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.derivative is not highly effective as a hedge or that it has ceased to be a highly effective hedge, the

Company discontinues hedge accounting prospectively, as discussed below.

Lexmark discontinues hedge accounting prospectively when (1) it is determined that a derivative is no

longer effective in offsetting changes in the fair value or cash flows of a hedged item; (2) the derivative

expires or is sold, terminated, or exercised or (3) the derivative is discontinued as a hedge instrument,

because it is unlikely that a forecasted transaction will occur. When hedge accounting is discontinued

because it is determined that the derivative no longer qualifies as an effective fair value hedge, the

derivative will continue to be carried on the Consolidated Statements of Financial Position at its fair value.

When hedge accounting is discontinued because it is probable that a forecasted transaction will not occur,

the derivative will continue to be carried on the Consolidated Statements of Financial Position at its fair

value, and gains and losses that were recorded in Accumulated other comprehensive earnings (loss) are

recognized immediately in earnings. In all other situations in which hedge accounting is discontinued, the

derivative will be carried at its fair value on the Consolidated Statements of Financial Position, with

changes in its fair value recognized in current period earnings. A fair value hedge is entered into when the

derivative instrument, for which hedge accounting has been discontinued, exposes earnings to further

change in exchange rates. An immaterial portion of the Company’s cash flow hedges was determined to be

ineffective, and recognized in current period earnings, during 2007, 2006 and 2005.

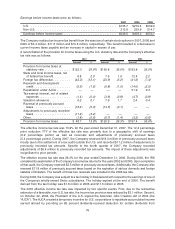

Lexmark recorded $8.2 million, $4.6 million and $3.0 million of aggregate net foreign currency transaction

losses in 2007, 2006 and 2005, respectively. The aggregate foreign currency transaction net loss amounts

include the gains/losses on the Company’s foreign currency fair value hedges for all periods presented.

Financial Instruments

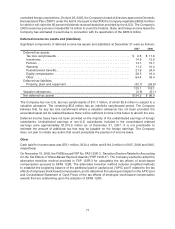

As of December 31, 2007 and 2006, the carrying value of Lexmark’s $150.0 million of senior note debt was

$149.9 million and $149.8 million, respectively, and the fair value was $150.3 million and $152.0 million,

respectively. The fair value of the debt was estimated based on current rates available to the Company for

debt with similar characteristics. As the notes mature in May 2008, the senior notes were reclassified from

Long-term debt to Current portion of long-term debt during 2007. As of December 31, 2007 and 2006, the

Company had no short-term debt outstanding.

During October 2003, Lexmark entered into interest rate swap contracts to convert its $150.0 million

principal amount of 6.75% senior notes from a fixed interest rate to a variable interest rate. The interest rate

swaps are designated as a fair value hedge of the Company’s $150.0 million long-term debt. The interest

rate swaps are recorded at their fair value and the Company’s long-term debt is adjusted by the same

corresponding value in accordance with the short-cut method of SFAS 133. The fair value of the interest

rate swaps is combined with the fair value adjustment of the Company’s senior note debt due to

immateriality and was presented in Long-term debt at December 31, 2006, and in Current portion of

long-term debt at December 31, 2007, on the Consolidated Statements of Financial Position. As of

December 31, 2007 and 2006, the fair value of the interest rate swap contracts was an asset of $0.1 million

and a liability of $2.2 million, respectively.

Concentrations of Risk

Lexmark’s main concentrations of credit risk consist primarily of short-term cash investments, marketable

securities and trade receivables. Short-term cash and marketable securities investments are made in a

variety of high quality securities with prudent diversification requirements. The Company seeks

diversification among its cash investments by limiting the amount of cash investments that can be

made with any one obligor. Credit risk related to trade receivables is dispersed across a large number

of customers located in various geographic areas. Collateral such as letters of credit and bank guarantees

is required in certain circumstances. Lexmark sells a large portion of its products through third-party

distributors and resellers and original equipment manufacturer (“OEM”) customers. If the financial

condition or operations of these distributors, resellers and OEM customers were to deteriorate

substantially, the Company’s operating results could be adversely affected. The three largest

86