Lexmark 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

incurred one-time termination benefit charges of $10.4 million related to a workforce reduction plan. For

the $10.4 million of one-time termination benefit charges, the Company recorded $6.5 million in its

Business segment, $2.6 million in its Consumer segment and $1.3 million in All other. See “Restructuring-

related Charges, Project Costs and Other” that follows for further discussion.

Interest and Other

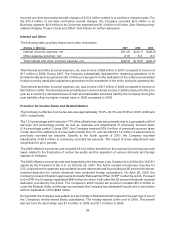

The following table provides interest and other information:

(Dollars in Millions) 2007 2006 2005

Interest (income) expense, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(21.2) $(22.1) $(26.5)

Other expense (income), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.0) 5.3 6.5

Total interest and other (income) expense, net . . . . . . . . . . . . . . . . . . . . $(28.2) $(16.8) $(20.0)

Total interest and other (income) expense, net, was income of $28 million in 2007 compared to income of

$17 million in 2006. During 2007, the Company substantially liquidated the remaining operations of its

Scotland entity and recognized an $8.1 million pre-tax gain from the realization of the entity’s accumulated

foreign currency translation adjustment generated on the investment in the entity during its operating life.

Total interest and other (income) expense, net, was income of $17 million in 2006 compared to income of

$20 million in 2005. This decrease was primarily due to lower interest income in 2006 compared to the prior

year as a result of a decreased level of cash and marketable securities held by the Company during the

year partially offset by higher interest rates in 2006 compared to 2005.

Provision for Income Taxes and Related Matters

The Company’s effective income tax rate was approximately 13.9%, 26.3% and 35.6% in 2007, 2006 and

2005, respectively.

The 12.4 percentage point reduction YTYof the effective tax rate was primarily due to a geographic shift of

earnings (6.9 percentage points) as well as reversals and adjustments of previously accrued taxes

(5.4 percentage points). During 2007, the Company reversed $18.4 million of previously accrued taxes

mostly due to the settlement of a tax audit outside the U.S. and recorded $11.2 million of adjustments to

previously recorded tax amounts. Specific to the fourth quarter of 2007, the Company recorded

adjustments of $6.4 million to previously recorded tax amounts. The impact of these adjustments was

insignificant to prior periods.

The 2006 effective income tax rate included a $14.3 million benefit from the reversal of previously accrued

taxes related to the finalization of certain tax audits and the expiration of various domestic and foreign

statutes of limitation.

The 2005 effective income tax rate was impacted by the American Jobs Creation Act of 2004 (the “AJCA”)

signed by the President of the U.S. on October 22, 2004. The AJCA created a temporary incentive for

U.S. corporations to repatriate accumulated income earned abroad by providing an 85 percent dividends-

received deduction for certain dividends from controlled foreign corporations. On April 28, 2005, the

Company’s board of directors approved a Domestic Reinvestment Plan (“DRP”) under the AJCA. Pursuant

to the DRP, the Company repatriated $684 million for which it will claim the 85 percent dividends-received

deduction provided by the AJCA. The Company’s 2005 income tax provision included $51.9 million to

cover the Federal, State, and foreign income taxes the Company has estimated it would owe in connection

with its repatriation of the $684 million.

During 2006, the Company was subject to a tax holiday in Switzerland with respect to the earnings of one of

the Company’s wholly-owned Swiss subsidiaries. The holiday expired at the end of 2006. The benefit

derived from the tax holiday was $1.6 million in 2006 and $11.5 million in 2005.

39