Lexmark 2007 Annual Report Download - page 53

Download and view the complete annual report

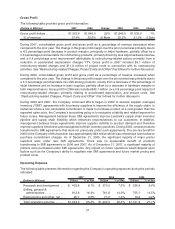

Please find page 53 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2007, the Company’s marketable securities portfolio consisted of asset-backed and

mortgage-backed securities, corporate debt securities, municipal debt securities, U.S. government and

agency debt securities, and preferred securities, including approximately $79 million of auction rate

securities. The Company’s marketable securities were reported at fair value with the related unrealized

gains and losses included in the Accumulated other comprehensive earnings (loss) section of

stockholders’ equity, net of tax. As of December 31, 2007 the Company had gross unrealized gains

and gross unrealized losses of $1.5 million and $1.5 million, respectively. Based upon several factors

including events that may affect the creditworthiness of a security’s issuer, the length of time the security

has been in a loss position, and the Company’s ability and intent to hold the security until a forecasted

recovery of fair value, the Company assessed its loss positions as temporary impairments. Substantially

all of the unrealized losses and gains as of December 31, 2007, have been in a gain/loss position for less

than 12 months.

The Company spent $183 million, $200 million and $201 million on capital expenditures during 2007, 2006

and 2005, respectively. The capital expenditures in 2007 were related to new product development,

infrastructure support and manufacturing capacity expansion.

During the first quarter of 2007, the Company sold its Rosyth, Scotland facility for $8.1 million and

recognized a $3.5 million pre-tax gain on the sale.

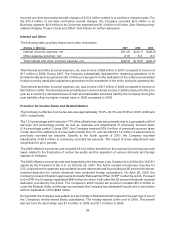

Financing activities

The fluctuations in the net cash flows used for financing activities were principally due to the Company’s

share repurchase activity. The Company repurchased $0.2 billion, $0.9 billion and $1.1 billion of treasury

stock during 2007, 2006 and 2005, respectively.

Credit Facility

Effective January 20, 2005, Lexmark entered into a $300 million 5-year senior, unsecured, multi-currency

revolving credit facility with a group of banks. Under the credit facility, the Company may borrow in dollars,

euros, British pounds sterling and Japanese yen. Under certain circumstances, the aggregate amount

available under the facility may be increased to a maximum of $500 million. As of December 31, 2007 and

2006, there were no amounts outstanding under the credit facility.

Lexmark’s credit agreement contains usual and customary default provisions, leverage and interest

coverage restrictions and certain restrictions on secured and subsidiary debt, disposition of assets, liens

and mergers and acquisitions. The $300 million credit facility has a maturity date of January 20, 2010.

Interest on all borrowings under the facility depends upon the type of loan, namely alternative base rate

loans, swingline loans or eurocurrency loans. Alternative base rate loans bear interest at the greater of the

prime rate or the federal funds rate plus one-half of one percent. Swingline loans (limited to $50 million)

bear interest at an agreed upon rate at the time of the borrowing. Eurocurrency loans bear interest at the

sum of (i) a LIBOR for the applicable currency and interest period and (ii) an interest rate spread based

upon the Company’s debt ratings ranging from 0.18% to 0.80%. In addition, Lexmark is required to pay a

facility fee on the $300 million line of credit of 0.07% to 0.20% based upon the Company’s debt ratings. The

interest and facility fees are payable at least quarterly.

Senior Notes — Long-term Debt and Current Portion of Long-term Debt

Lexmark has outstanding $150.0 million principal amount of 6.75% senior notes due May 15, 2008, which

was initially priced at 98.998%, to yield 6.89% to maturity. A balance of $149.9 million (net of the

unamortized discount of $0.1 million) was outstanding at December 31, 2007. At December 31, 2006,

the balance was $149.8 million (net of the unamortized discount of $0.2 million). As the notes mature in

May 2008, the senior notes were reclassified from Long-term debt to Current portion of long-term debt

during 2007.

47