Lexmark 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

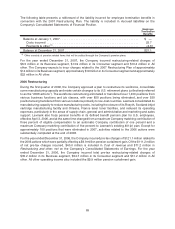

and the noncontrolling interest on the face of the income statement. In addition, SFAS 160 requires a

parent to recognize a gain or loss in net income on the date the parent deconsolidates a subsidiary, or

ceases to have a controlling financial interest in a subsidiary. SFAS 160 is effective for the Company

beginning January 1, 2009, and will apply prospectively, except for the presentation of disclosure

requirements, which must be applied retrospectively. The Company does not expect the adoption of

SFAS 160 will have a material impact on its financial position, results of operations and cash flows.

Reclassifications:

Certain prior year amounts have been reclassified, if applicable, to conform to the current presentation.

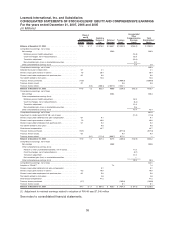

3. RESTRUCTURING-RELATED CHARGES AND OTHER

2007 Restructuring

As part of its ongoing efforts to optimize its cost and expense structure, the Company continually reviews

its resources in light of a variety of factors. On October 23, 2007, the Company announced a plan (the

“2007 Restructuring Plan”) which includes:

• Closure of one of the Company’s inkjet supplies manufacturing facilities in Mexico and additional

optimization measures at the remaining inkjet facilities in Mexico and the Philippines.

• Reduction of the Company’s business support cost and expense structure by further consolidating

activity globally and expanding the use of shared service centers in lower-cost regions. The areas

impacted are supply chain, service delivery, general and administrative expense, as well as

marketing and sales support functions.

• Focusing consumer segment marketing and sales efforts into countries or geographic regions that

have the highest supplies usage.

The 2007 Restructuring Plan is expected to impact approximately 1,650 positions by the end of 2008. Most

of the impacted positions are being moved to lower-cost countries. The Company expects the 2007

Restructuring Plan will result in pre-tax charges of approximately $55 million, of which $40 million will

require cash. The Company expects the 2007 Restructuring Plan to be substantially completed by the end

of 2008.

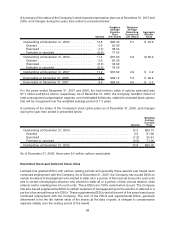

For the year ended December 31, 2007, the Company incurred $30.8 million for the 2007 Restructuring

Plan as follows:

Accelerated depreciation charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5.1

Employee termination benefit charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.7

Total restructuring-related charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $30.8

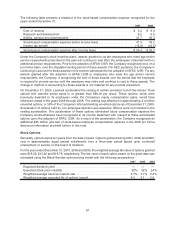

The accelerated depreciation charges were determined in accordance with SFAS No. 144, Accounting for

the Impairment or Disposal of Long-Lived Assets. The accelerated depreciation charges are included in

Cost of revenue on the Consolidated Statements of Earnings.

Employee termination benefit charges were accrued in accordance with SFAS No. 112, Employers’

Accounting for Postemployment Benefits and SFAS No. 146, Accounting for Costs Associated with Exit or

Disposal Activities, as appropriate. Employee termination benefit charges include severance, medical and

other benefits and are included in Restructuring and other, net on the Consolidated Statements of

Earnings.

64