Lexmark 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

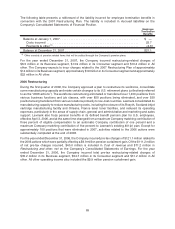

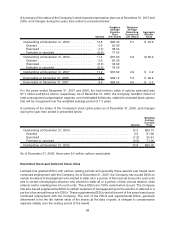

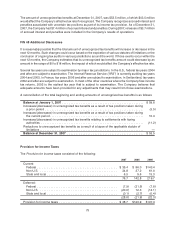

A summary of the status of the Company’s RSU and DSU grants as of December 31, 2007 and 2006, and

changes during the year then ended is presented below:

Units

Weighted

Average

Grant Date

Fair Value

(Per Share)

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

RSUs and DSUs at December 31, 2005 . . . . . . . . . . . 0.4 $54.55 4.2 $18.4

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.6 48.75

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.1) 35.52

Forfeited or canceled . . . . . . . . . . . . . . . . . . . . . . . . (0.1) 54.89

RSUs and DSUs at December 31, 2006 . . . . . . . . . . . 0.8 $52.84 3.5 $61.9

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.5 56.08

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.1) 58.62

Forfeited or canceled . . . . . . . . . . . . . . . . . . . . . . . . — 54.43

RSUs and DSUs at December 31, 2007 . . . . . . . . . . . 1.2 $53.79 2.6 $42.6

For the years ended December 31, 2007 and 2006, the total fair value of RSUs and DSUs that vested was

$3.2 million and $4.9 million, respectively. As of December 31, 2007, the Company had $33.7 million of

total unrecognized compensation expense, net of estimated forfeitures, related to RSUs and DSUs that will

be recognized over the weighted average period of 3.1 years.

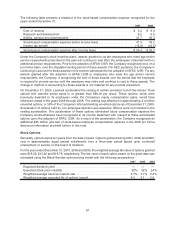

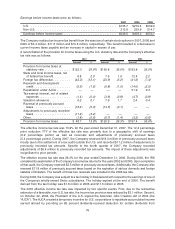

Employee Stock Purchase Plan

The Company’s Employee Stock Purchase Plan (“ESPP”) enables substantially all regular employees to

purchase full or fractional shares of Lexmark Class A Common Stock through payroll deductions of up to

10% of eligible compensation. Effective January 1, 2006, the ESPP was amended whereby the share price

paid by an employee is 85% of the closing market price on the last business day of the respective offering

period. Prior to January 1, 2006, the share price paid by an employee was 85% of the lesser of the closing

market price on (i) the last business day immediately preceding the first day of the respective offering

period and (ii) the last business day of the respective offering period. The ESPP provides semi-annual

offering periods beginning each January 1 and July 1. During the years ended December 31, 2007, 2006

and 2005, employees paid the Company $5.6 million, $6.2 million and $8.6 million, respectively, to

purchase approximately 0.1 million shares during each of these years. During 2007 and 2006, the

Company recognized approximately $0.9 million and $1.9 million of compensation expense related to this

ESPP activity due to the adoption of SFAS 123R mentioned earlier. Compensation expense was

calculated using the fair value of the employees’ purchase rights under the Black-Scholes model.

The Company discontinued the ESPP as of December 31, 2007. Employees enrolled in the ESPP during

the offering period that ended December 31, 2007, qualified for the final ESPP purchase executed

according the plan provisions described above.

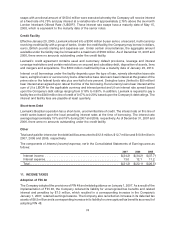

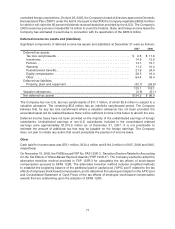

Pro Forma Information for Periods Prior to Adopting SFAS 123R

Prior to the adoption of SFAS 123R on January 1, 2006, the Company accounted for its stock-based

employee compensation plans under APB 25 and related interpretations. Under APB 25, compensation

cost was not recognized for substantially all options granted because the exercise price was at least equal

to the market value of the underlying common stock on the date of grant.

69