Lexmark 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

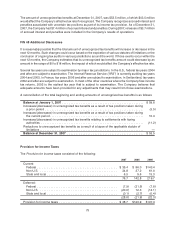

controlled foreign corporations. On April 28, 2005, the Company’s board of directors approved a Domestic

Reinvestment Plan (“DRP”) under the AJCA. Pursuant to the DRP, the Company repatriated $683.9 million

for which it will claim the 85 percent dividends-received deduction provided by the AJCA. The Company’s

2005 income tax provision included $51.9 million to cover the Federal, State, and foreign income taxes the

Company has estimated it would owe in connection with its repatriation of the $683.9 million.

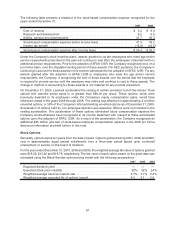

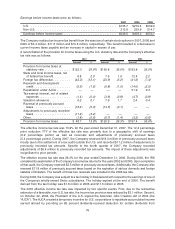

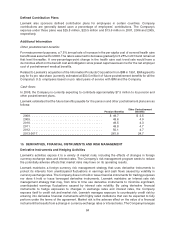

Deferred income tax assets and (liabilities)

Significant components of deferred income tax assets and (liabilities) at December 31 were as follows:

2007 2006

Deferred tax assets:

Tax loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.6 $ 11.6

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.5 13.6

Pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.7 19.7

Warranty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.2 10.2

Postretirement benefits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.9 24.0

Equity compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.5 16.4

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64.4 36.4

Deferred tax liabilities:

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (32.7) (29.8)

125.1 102.1

Valuation allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.9) (6.1)

Net deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $124.2 $ 96.0

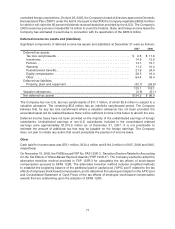

The Company has non-U.S. tax loss carryforwards of $11.7 million, of which $5.9 million is subject to a

valuation allowance. The remaining $5.8 million has an indefinite carryforward period. The Company

believes that, for any tax loss carryforward where a valuation allowance has not been provided, the

associated asset will be realized because there will be sufficient income in the future to absorb the loss.

Deferred income taxes have not been provided on the majority of the undistributed earnings of foreign

subsidiaries. Undistributed earnings of non-U.S. subsidiaries included in the consolidated retained

earnings were approximately $1,010.6 million as of December 31, 2007. It is not practicable to

estimate the amount of additional tax that may be payable on the foreign earnings. The Company

does not plan to initiate any action that would precipitate the payment of income taxes.

Other

Cash paid for income taxes was $76.1 million, $134.4 million and $164.2 million in 2007, 2006 and 2005,

respectively.

On November 10, 2005, the FASB issued FSP No. FAS 123R-3, Transition Election Related to Accounting

for the Tax Effects of Share-Based Payment Awards (“FSP 123R-3”). The Company elected to adopt the

alternative transition method provided in FSP 123R-3 for calculating the tax effects of stock-based

compensation pursuant to SFAS 123R. The alternative transition method includes simplified methods

to establish the beginning balance of the additional paid-in capital pool (“APIC pool”) related to the tax

effects of employee stock-based compensation, and to determine the subsequent impact on the APIC pool

and Consolidated Statement of Cash Flows of the tax effects of employee stock-based compensation

awards that are outstanding upon the adoption of SFAS 123R.

77