Lexmark 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

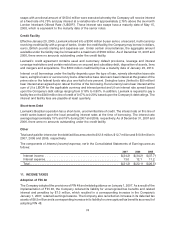

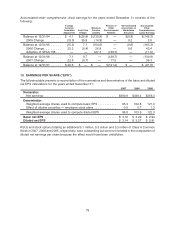

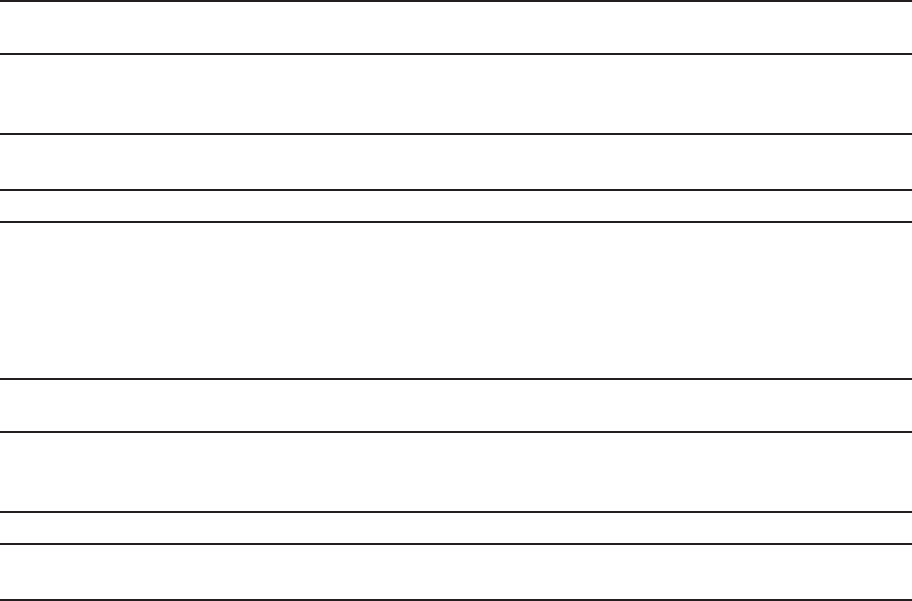

Accumulated other comprehensive (loss) earnings for the years ended December 31 consists of the

following:

Foreign

Currency

Translation

Adjustment

Cash Flow

Hedges

Minimum

Pension

Liability

Pension or

Other

Postretirement

Benefits

Net Unrealized

(Loss) Gain on

Marketable

Securities

Accumulated

Other

Comprehensive

(Loss) Earnings

Balance at 12/31/04 . . . . . . $ 4.1 $(28.8) $(139.8) $ — $(0.8) $(165.3)

2005 Change. . . . . . . . . . (19.3) 35.9 (14.8) — 0.2 2.0

Balance at 12/31/05 . . . . . . (15.2) 7.1 (154.6) — (0.6) (163.3)

2006 Change. . . . . . . . . . 22.3 (6.4) 26.9 — 0.6 43.4

Adoption of SFAS 158 . . . — — 127.7 (138.7) — (11.0)

Balance at 12/31/06 . . . . . . 7.1 0.7 — (138.7) — (130.9)

2007 Change. . . . . . . . . . 22.5 (0.7) — 17.5 — 39.3

Balance at 12/31/07 . . . . . . $ 29.6 $ — $ — $(121.2) $ — $ (91.6)

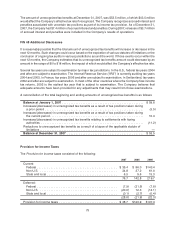

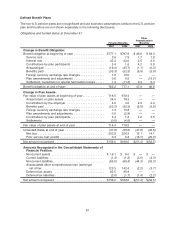

13. EARNINGS PER SHARE (“EPS”)

The following table presents a reconciliation of the numerators and denominators of the basic and diluted

net EPS calculations for the years ended December 31:

2007 2006 2005

Numerator:

Net earnings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $300.8 $338.4 $356.3

Denominator:

Weighted average shares used to compute basic EPS . . . . . . . . . . . 95.3 102.8 121.0

Effect of dilutive securities — employee stock plans . . . . . . . . . . . . . 0.5 0.7 1.3

Weighted average shares used to compute diluted EPS . . . . . . . . . . 95.8 103.5 122.3

Basic net EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.16 $ 3.29 $ 2.94

Diluted net EPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.14 $ 3.27 $ 2.91

RSUs and stock options totaling an additional 5.1 million, 5.3 million and 3.3 million of Class A Common

Stock in 2007, 2006 and 2005, respectively, were outstanding but were not included in the computation of

diluted net earnings per share because the effect would have been antidilutive.

79