Lexmark 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

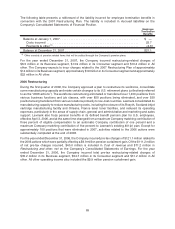

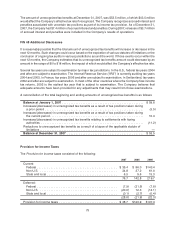

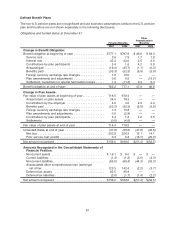

9. ACCRUED LIABILITIES AND OTHER LIABILITIES

Accrued liabilities, in the current liabilities section of the balance sheet, consisted of the following at

December 31:

2007 2006

Copyright fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $117.5 $ 97.8

Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111.0 132.3

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84.1 81.9

Marketing programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67.1 72.9

Warranty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62.3 62.7

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 268.5 276.1

Accrued liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $710.5 $723.7

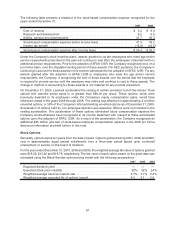

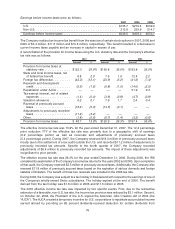

In accordance with the disclosure requirements of FIN 45, changes in the Company’s aggregate warranty

liability, which includes both warranty and extended warranty (deferred revenue), are presented below:

2007 2006

Balance at January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 212.4 $ 195.0

Accruals for warranties issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 284.9 231.5

Accruals related to pre-existing warranties (including amortization of deferred

revenue for extended warranties and changes in estimates) . . . . . . . . . . . . (57.9) (53.0)

Settlements made (in cash or in kind) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (188.2) (161.1)

Balance at December 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 251.2 $ 212.4

Both warranty and the short-term portion of extended warranty are included in Accrued liabilities on the

Consolidated Statements of Financial Position. The long-term portion of extended warranty is included in

Other liabilities on the Consolidated Statements of Financial Position.

Other liabilities, in the noncurrent liabilities section of the balance sheet, consisted of the following at

December 31:

2007 2006

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $124.3 $ 85.5

Pension/Postretirement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117.9 119.6

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103.3 134.9

Other liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $345.5 $340.0

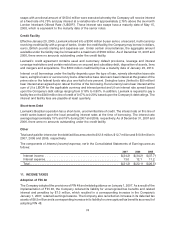

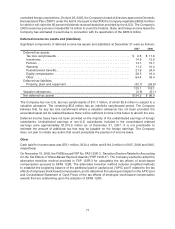

10. DEBT

Senior Notes — Long-term Debt and Current Portion of Long-term Debt

Lexmark has outstanding $150.0 million principal amount of 6.75% senior notes due May 15, 2008, which

was initially priced at 98.998%, to yield 6.89% to maturity. A balance of $149.9 million (net of the

unamortized discount of $0.1 million) was outstanding at December 31, 2007. At December 31, 2006,

the balance was $149.8 million (net of the unamortized discount of $0.2 million). As the notes mature in

May 2008, the senior notes were reclassified from Long-term debt to Current portion of long-term debt

during 2007.

The senior notes contain typical restrictions on liens, sale leaseback transactions, mergers and sales of

assets. There are no sinking fund requirements on the senior notes and they may be redeemed at any time

at the option of the Company, at a redemption price as described in the related indenture agreement, as

supplemented and amended, in whole or in part.

During October 2003, the Company entered into interest rate swap contracts to convert its $150.0 million

principal amount of 6.75% senior notes from a fixed interest rate to a variable interest rate. Interest rate

73