Lexmark 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

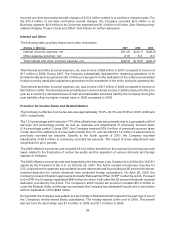

Additionally, during 2007, the Company incurred incremental charges related to the execution of its 2007

Restructuring Plan and its 2006 actions (collectively referred to as “project costs”). Net earnings in 2007

included $21.2 million (net of a $3.5 million pre-tax gain on the sale of the Rosyth, Scotland facility) of these

pre-tax project costs. See “Restructuring-related Charges, Project Costs and Other” that follows for further

discussion. Net earnings in 2007 also included an $8.1 million pre-tax foreign exchange gain realized upon

the substantial liquidation of the Company’s Scotland entity, an $18 million tax benefit primarily related to

the settlement of a tax audit outside the U.S. and an $11 million tax benefit resulting from adjustments to

previously recorded taxes.

Net earnings for the year ended December 31, 2006, decreased 5% from the prior year primarily due to

lower operating income partially offset by a lower effective tax rate. Net earnings in 2006 included

$135.1 million of pre-tax restructuring-related charges and project costs, a $9.9 million pre-tax pension

curtailment gain and a $14.3 million income tax benefit from the reversal of previously accrued taxes

related to the finalization of certain tax audits and the expiration of various domestic and foreign statutes of

limitation. Net earnings in 2005 included increased income tax expense of $51.9 million resulting from the

repatriation of foreign dividends during 2005 and $10.4 million of one-time pre-tax termination benefit

charges related to a 2005 workforce reduction plan.

Additionally, for the years ended December 31, 2007 and 2006, the Company incurred pre-tax stock-based

compensation expense under SFAS 123R of $41.3 million and $43.2 million, respectively. The Company

recorded pre-tax compensation expense of $2.9 million in 2005 related to its stock incentive plans prior to

the adoption of SFAS 123R.

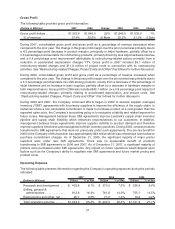

Revenue

The following tables provide a breakdown of the Company’s revenue by product category, hardware unit

shipments and market segment:

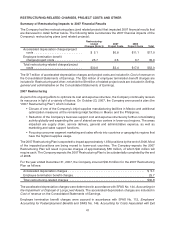

Revenue by product:

(Dollars in Millions) 2007 2006 % Change 2006 2005 % Change

Laser and inkjet printers . . . $1,498.3 $1,663.0 (10)% $1,663.0 $1,799.4 (8)%

Laser and inkjet supplies . . . 3,248.6 3,211.6 1% 3,211.6 3,117.2 3%

Other . . . . . . . . . . . . . . . . . . 227.0 233.5 (3)% 233.5 304.9 (23)%

Total revenue. . . . . . . . . . . . $4,973.9 $5,108.1 (3)% $5,108.1 $5,221.5 (2)%

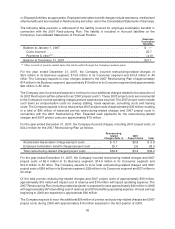

Unit shipments:

(Units in Millions) 2007 2006 2005

Laser units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.1 2.1 2.0

Inkjet units. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.1 14.7 18.4

During 2007, laser and inkjet supplies revenue increased 1% YTY as good growth in laser supplies was

mostly offset by a decline in inkjet supplies. Laser and inkjet hardware revenue decreased 10% primarily

due to a decline in inkjet units.

During 2006, laser and inkjet supplies revenue increased 3% YTY as good growth in laser supplies was

partially offset by a decline in inkjet supplies. Laser and inkjet hardware revenue decreased 8% with growth

in laser hardware units more than offset by the decline in inkjet hardware units.

During 2007, 2006 and 2005, one customer, Dell, accounted for $717 million or approximately 14%,

$744 million or approximately 15% and $782 million or approximately 15%, of the Company’s total

revenue, respectively. Sales to Dell are included in both the Business and Consumer segments.

35