Lexmark 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Goodwill and Other Intangible Assets:

Lexmark annually reviews its goodwill for impairment and currently does not have any indefinite-lived

intangible assets. The Company’s goodwill and intangible assets are immaterial, and therefore are not

separately presented in the Consolidated Statements of Financial Position.

Long-Lived Assets:

Lexmark performs reviews for the impairment of long-lived assets whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. An impairment

loss is recognized when estimated undiscounted future cash flows expected to result from the use of the

asset and its eventual disposition are less than its carrying amount. If future expected undiscounted cash

flows are insufficient to recover the carrying value of the assets, then an impairment loss is recognized

based upon the excess of the carrying value of the asset over the anticipated cash flows on a discounted

basis.

Lexmark also reviews any legal and contractual obligations associated with the retirement of its long-lived

assets and records assets and liabilities, as necessary, related to the cost of such obligations. Costs

associated with such obligations that are reasonably estimable and probable are accrued and expensed,

or capitalized as appropriate. The asset recorded shall be recorded during the period in which it occurs and

shall be amortized over the useful life of the related long-lived tangible asset. The liability recorded is

relieved when the costs are incurred to retire the related long-lived tangible asset. The Company’s asset

retirement obligations are currently not material.

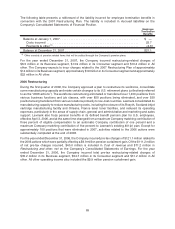

Warranty:

Lexmark provides for the estimated cost of product warranties at the time revenue is recognized. The

amounts accrued for product warranties is based on the quantity of units sold under warranty, estimated

product failure rates, and material usage and service delivery costs. The estimates for product failure rates

and material usage and service delivery costs are periodically adjusted based on actual results. For

extended warranty programs, the Company defers revenue in short-term and long-term liability accounts

(based on the extended warranty contractual period) for amounts invoiced to customers for these

programs and recognizes the revenue ratably over the contractual period. Costs associated with

extended warranty programs are expensed as incurred.

Revenue Recognition:

General

Lexmark recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred,

the sales price is fixed or determinable and collectibility is reasonably assured. Revenue as reported in the

Company’s Consolidated Statements of Earnings is reported net of any taxes (e.g., sales, use, value

added) assessed by a governmental entity that is directly imposed on a revenue-producing transaction

between a seller and a customer.

The following are the policies applicable to Lexmark’s major categories of revenue transactions:

Products

Revenue from product sales, including sales to distributors and resellers, is recognized when title and risk

of loss transfer to the customer, generally when the product is shipped to the customer. When other

significant obligations remain after products are delivered, such as contractual requirements pertaining to

customer acceptance, revenue is recognized only after such obligations are fulfilled. At the time revenue is

recognized, the Company provides for the estimated cost of post-sales support, principally product

warranty, and reduces revenue for estimated product returns.

58