Lexmark 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

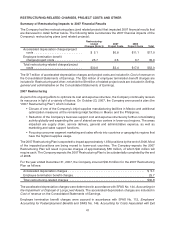

restructuring-related charges and 2006 project costs of $35.9 million in its Business segment, $57.2 million

in its Consumer segment and $42.0 million in All other. All other operating income also included the

$9.9 million pension curtailment gain.

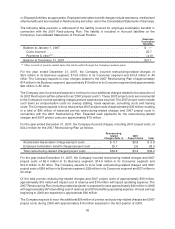

For the year ended December 31, 2007, the Company incurred additional 2006 project costs of

$17.8 million related to the completion of the 2006 actions. Of the $17.8 million of 2006 project costs

incurred, $11.1 million is included in Cost of revenue and $6.7 million in Selling, general and administrative

on the Company’s Consolidated Statements of Earnings. For the year ended December 31, 2007, the

Company incurred total pre-tax 2006 project costs of $5.7 million in its Business segment and $14.8 million

in All other while the Consumer segment realized a $2.7 million net benefit after the sale of the Rosyth,

Scotland facility discussed further below. The Company does not expect to incur any additional 2006

project costs during 2008.

During the first quarter of 2007, the Company sold its Rosyth, Scotland facility for $8.1 million and

recognized a $3.5 million pre-tax gain on the sale.

During the second quarter of 2007, the Company substantially liquidated the remaining operations of its

Scotland entity and recognized an $8.1 million pre-tax gain from the realization of the entity’s accumulated

foreign currency translation adjustment generated on the investment in the entity during its operating life.

This gain is included in Other (income) expense, net on the Company’s Consolidated Statements of

Earnings.

2005 Workforce Reduction

In order to optimize the Company’s expense structure, the Company approved a plan during the third

quarter of 2005 that would reduce its workforce by approximately 275 employees worldwide from various

business functions and job classes. The separation of the affected employees was completed by

December 31, 2005.

As of December 31, 2005, the Company incurred one-time termination benefit charges of $10.4 million

related to the plan that is included in Restructuring and other, net on the Consolidated Statements of

Earnings. For the $10.4 million of one-time termination benefit charges, the Company recorded $6.5 million

in its Business segment, $2.6 million in its Consumer segment and $1.3 million in All other.

PENSION AND OTHER POSTRETIREMENT PLANS

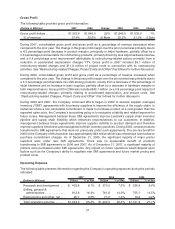

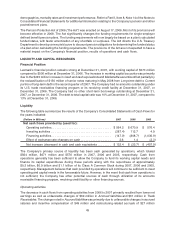

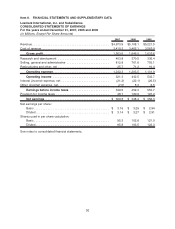

The following table provides the total pre-tax cost related to Lexmark’s retirement plans for the years 2007,

2006 and 2005. Cost amounts are included as an addition to the Company’s cost and expense amounts in

the Consolidated Statements of Earnings.

(Dollars in Millions) 2007 2006 2005

Total cost of pension and other postretirement plans . . . . . . . . . . . . . . . . . $40.2 $34.4 $43.8

Comprised of:

Defined benefit pension plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13.2 $12.5 $26.1

Defined contribution plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.8 20.5 13.6

Other postretirement plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.2 1.4 4.1

The decrease in the cost of defined benefit pension plans in 2006 was primarily due to the $9.9 million one-

time curtailment gain from the freezing of benefit accruals in the U.S. The increases in the cost of defined

contribution plans in 2007 and 2006 were primarily due to the enhancement of benefits in the U.S. Refer to

Part II, Item 8, Note 3 of the Notes to Consolidated Financial Statements for further details. The decrease

in the cost of other postretirement plans in 2006 was primarily due to plan design changes.

Changes in actuarial assumptions did not have a significant impact on the Company’s results of operations

in 2006 and 2007, nor are they expected to have a material effect in 2008. Future effects of retirement-

related benefits on the operating results of the Company depend on economic conditions, employee

44