Lexmark 2007 Annual Report Download - page 52

Download and view the complete annual report

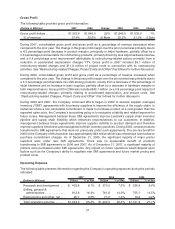

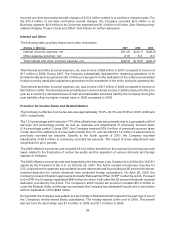

Please find page 52 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.compared to the prior year. The impact of accrued salaries and incentive compensation was driven by the

payment of 2006 bonuses in the first quarter of 2007. Bonuses earned in 2006 were considerably higher

than those earned in 2005 and 2007. Payments for such programs generally occur in the first quarter of the

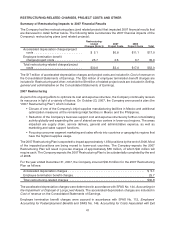

subsequent year. The impact of restructuring-related accruals was driven by the relatively small movement

in the liability in 2007 compared to that of 2006, resulting in a lower non-cash addition to net earnings when

deriving cash flows from operations. In 2007, there were approximately $26 million of accruals offset by

$23 million of payments and other adjustments, resulting in a non-cash addition to net earnings of only

$3 million related to the Company’s 2006 and 2007 restructuring actions. In 2006, there were

approximately $81 million of accruals offset partially by $51 million of payments and other

adjustments, resulting in a non-cash addition to net earnings of $30 million related to the Company’s

2006 restructuring actions. The $61 million change noted in Trade Receivables is primarily the result of

greater collections in the year 2006 versus 2007, the majority of which occurred in the first quarter. A

significantly higher trade receivables balance existed at December 31, 2005 versus December 31, 2006

due to a larger portion of the fourth quarter sales for 2005 occurring in the later part of the quarter.

The increase in cash flows from operating activities from 2005 to 2006 resulted from favorable changes in

Accrued liabilities and Accounts payable partially offset by unfavorable changes in Inventories and various

other assets and liabilities accounts. The change noted in Accrued liabilities was primarily due to increases

in salary and incentive compensation accruals and related payments of $67 million, favorable changes in

derivative liabilities of $42 million and increases in restructuring-related accruals of $28 million compared

to the prior year. Accounts payable balances can fluctuate significantly between periods due to the timing

of payments to suppliers. The unfavorable change in Inventories was primarily due to the growth in

supplies inventory. The change noted in the Other assets and liabilities line item in 2006 on the

Consolidated Statements of Cash Flows was primarily attributable to changes in various income tax-

related accounts from 2005.

The Company’s days of sales outstanding were 40 days at December 31, 2007, compared to 38 days at

December 31, 2006 and 43 days at December 31, 2005. The days of sales outstanding are calculated

using the quarter-end trade receivables, net of allowances, and the average daily revenue for the quarter.

The Company’s days of inventory were 48 days at December 31, 2007, compared to 44 days at

December 31, 2006 and 38 days at December 31, 2005. The days of inventory is calculated using the

quarter-end net inventories balance and the average daily cost of revenue for the quarter.

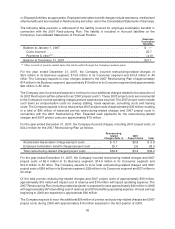

In connection with the 2007 restructuring, the remaining accrued liability balance at December 31, 2007, of

$21.1 million, is expected to be paid out primarily over 2008 and 2009. These payments will relate mainly to

employee termination benefits. In connection with the 2006 restructuring, the remaining accrued liability

balance at December 31, 2007 was $11.8 million. It is expected that the majority of this liability, which

consists of employee termination benefits and contract termination and lease charges, will be paid by the

end of 2008.

As of December 31, 2007, the Company had accrued approximately $117 million for pending copyright fee

issues, including litigation proceedings, local legislative initiatives and/or negotiations with the parties

involved. These accruals are included in Accrued liabilities on the Consolidated Statements of Financial

Position. Refer to Part II, Item 8, Note 16 of the Notes to Consolidated Financial Statements for additional

information.

Investing activities

The Company decreased its marketable securities investments in 2005 by $220 million and by $315 million

in 2006 due to its share repurchase program activity. In 2007, the Company increased its investment in

marketable securities by $113 million. Refer to the section, Stock Repurchase, which follows for further

discussion of the Company’s stock repurchase program during 2007. The fluctuations in the net cash flows

(used for) provided by investing activities for the years provided were principally due to the Company’s

marketable securities investing activities.

46