Lexmark 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Research and development increased in 2007 and 2006 compared to the prior year due to the Company’s

continued investment to support product and solution development. These continuing investments have

led to new products and solutions aimed at targeted growth segments.

Selling, general and administrative (“SG&A”) expenses in 2007 increased YTYas the Company continued

to increase spending on marketing and sales activities. During 2007, demand generation activities, which

include the brand development marketing campaign launched in late 2006, increased YTY. The initiative

includes a television advertising campaign along with radio and print advertising in targeted geographic

and market segments. Additionally, SG&A expenses in 2007 included $9.3 million of project costs (net of a

$3.5 million pre-tax gain on the sale of the Rosyth, Scotland facility). SG&A expenses in 2006 included

$11.9 million of project costs related to the 2006 actions. See “Restructuring-related Charges, Project

Costs and Other” that follows for further discussion. SG&A expenses in 2007 and 2006 also included

$31.7 million and $30.3 million of stock-based compensation expense due to the Company’s adoption of

SFAS 123R.

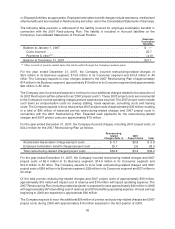

Restructuring and other, net, in 2007 included $25.7 million of restructuring-related charges in connection

with the 2007 Restructuring Plan. Restructuring and other, net, in 2006 included $81.1 million of

restructuring-related charges for the 2006 restructuring plan partially offset by a $9.9 million pension

curtailment gain. In 2005, the Company incurred $10.4 million of one-time termination benefit charges

related to the 2005 workforce reduction. See “Restructuring-related Charges, Project Costs and Other”

that follows for further discussion.

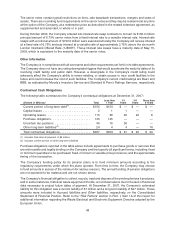

Operating Income (Loss)

The following table provides operating income by market segment:

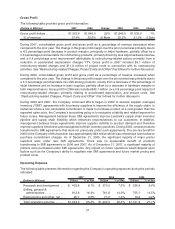

(Dollars in Millions) 2007 2006 Change 2006 2005 Change

Business . . . . . . . . . . . . . . . . . . . . $ 612.0 $ 600.1 2% $ 600.1 $ 661.0 (9)%

% of segment revenue ........ 20.4% 20.9% (0.5)pts 20.9% 23.8% (2.9)pts

Consumer . . . . . . . . . . . . . . . . . . . 93.4 246.0 (62)% $ 246.0 232.1 6%

% of segment revenue ........ 4.7% 11.0% (6.3)pts 11.0% 9.5% 1.5pts

All other . . . . . . . . . . . . . . . . . . . . . (384.1) (403.6) 5% $(403.6) (359.4) (12)%

Total operating income (loss) . . . . . $ 321.3 $ 442.5 (27)% $ 442.5 $ 533.7 (17)%

% of total revenue ........... 6.5% 8.7% (2.2)pts 8.7% 10.2% (1.5)pts

For the year ended December 31, 2007, the decrease in consolidated operating income was due to

decreased gross profits and higher operating expenses partially offset by a reduction in restructuring-

related charges and project costs YTY as discussed above. Operating income for the Business segment

increased YTYas higher gross profits, reflecting increased supplies revenue, were partially offset by higher

operating expense, reflecting higher marketing and sales and product development investments.

Operating income for the Consumer segment decreased YTY due to lower supplies revenue, lower

product margins and increased operating expenses.

For the year ended December 31, 2006, the decrease in consolidated operating income was due to

increased operating expenses partially offset by increased gross profits. Operating income for the

Business segment decreased due to lower gross profits, the impact of restructuring-related charges

and project costs and the increased investment in research and development. Operating income for the

Consumer segment increased due to increased gross profits partially offset by the impact of restructuring-

related charges and project costs.

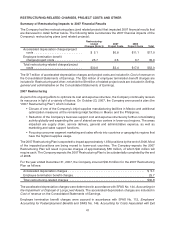

During 2007, the Company incurred total pre-tax restructuring-related charges and project costs of

$12.1 million in its Business segment, $12.2 million in its Consumer segment and $27.7 million in All

other. During 2006, the Company incurred restructuring-related charges and project costs of $35.9 million

in its Business segment, $57.2 million in its Consumer segment and $42.0 million in All other. All other

operating income in 2006 also included a $9.9 million pension curtailment gain. During 2005, the Company

38