Lexmark 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The senior notes contain typical restrictions on liens, sale leaseback transactions, mergers and sales of

assets. There are no sinking fund requirements on the senior notes and they may be redeemed at any time

at the option of the Company, at a redemption price as described in the related indenture agreement, as

supplemented and amended, in whole or in part.

During October 2003, the Company entered into interest rate swap contracts to convert its $150.0 million

principal amount of 6.75% senior notes from a fixed interest rate to a variable interest rate. Interest rate

swaps with a notional amount of $150.0 million were executed whereby the Company will receive interest

at a fixed rate of 6.75% and pay interest at a variable rate of approximately 2.76% above the six-month

London Interbank Offered Rate (“LIBOR”). These interest rate swaps have a maturity date of May 15,

2008, which is equivalent to the maturity date of the senior notes.

Other Information

The Company is in compliance with all covenants and other requirements set forth in its debt agreements.

The Company does not have any rating downgrade triggers that would accelerate the maturity dates of its

revolving credit facility and public debt. However, a downgrade in the Company’s credit rating could

adversely affect the Company’s ability to renew existing, or obtain access to new, credit facilities in the

future and could increase the cost of such facilities. The Company’s current credit ratings are Baa1 and

BBB, as evaluated by Moody’s Investors Service and Standard & Poor’s Ratings Services, respectively.

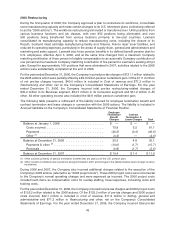

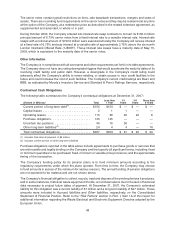

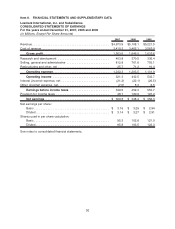

Contractual Cash Obligations

The following table summarizes the Company’s contractual obligations at December 31, 2007:

(Dollars in Millions) Total

Less than

1 Year

1-3

Years

3-5

Years

More than

5 Years

Current portion of long-term debt

(1)

. . . . . . . . . . . . $155 $155 $ — $ — $ —

Capital leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 1 1 — —

Operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . 115 38 46 23 8

Purchase obligations . . . . . . . . . . . . . . . . . . . . . . . 145 145 — — —

Uncertain tax positions . . . . . . . . . . . . . . . . . . . . . 46 16 30 — —

Other long-term liabilities

(2)

.................. 24 4 4 — 16

Total contractual obligations. . . . . . . . . . . . . . . . . . $487 $359 $ 81 $ 23 $ 24

(1) includes final interest payment of $5 million

(2) includes current portion of other long-term liabilities

Purchase obligations reported in the table above include agreements to purchase goods or services that

are enforceable and legally binding on the Company and that specify all significant terms, including: fixed

or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate

timing of the transaction.

The Company’s funding policy for its pension plans is to fund minimum amounts according to the

regulatory requirements under which the plans operate. From time to time, the Company may choose

to fund amounts in excess of the minimum for various reasons. The annual funding of pension obligations

are not expected to be material and are not shown above.

The Company’s financial obligation to collect, recycle, treat and dispose of the printing devices it produces,

and in some instances, historical waste equipment it holds, is not shown above due to the lack of historical

data necessary to project future dates of payment. At December 31, 2007, the Company’s estimated

liability for this obligation was a current liability of $1 million and a long-term liability of $27 million. These

amounts were included in Accrued liabilities and Other liabilities, respectively, on the Consolidated

Statement of Financial Position. Refer to the “Risk Factors” section in Part I, Item 1A of this report for

additional information regarding the Waste Electrical and Electronic Equipment Directive adopted by the

European Union.

48