Lexmark 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

swaps with a notional amount of $150.0 million were executed whereby the Company will receive interest

at a fixed rate of 6.75% and pay interest at a variable rate of approximately 2.76% above the six-month

London Interbank Offered Rate (“LIBOR”). These interest rate swaps have a maturity date of May 15,

2008, which is equivalent to the maturity date of the senior notes.

Credit Facility

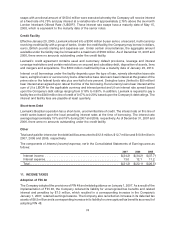

Effective January 20, 2005, Lexmark entered into a $300 million 5-year senior, unsecured, multi-currency

revolving credit facility with a group of banks. Under the credit facility, the Company may borrow in dollars,

euros, British pounds sterling and Japanese yen. Under certain circumstances, the aggregate amount

available under the facility may be increased to a maximum of $500 million. As of December 31, 2007 and

2006, there were no amounts outstanding under the credit facility.

Lexmark’s credit agreement contains usual and customary default provisions, leverage and interest

coverage restrictions and certain restrictions on secured and subsidiary debt, disposition of assets, liens

and mergers and acquisitions. The $300 million credit facility has a maturity date of January 20, 2010.

Interest on all borrowings under the facility depends upon the type of loan, namely alternative base rate

loans, swingline loans or eurocurrency loans. Alternative base rate loans bear interest at the greater of the

prime rate or the federal funds rate plus one-half of one percent. Swingline loans (limited to $50 million)

bear interest at an agreed upon rate at the time of the borrowing. Eurocurrency loans bear interest at the

sum of (i) a LIBOR for the applicable currency and interest period and (ii) an interest rate spread based

upon the Company’s debt ratings ranging from 0.18% to 0.80%. In addition, Lexmark is required to pay a

facility fee on the $300 million line of credit of 0.07% to 0.20% based upon the Company’s debt ratings. The

interest and facility fees are payable at least quarterly.

Short-term Debt

Lexmark’s Brazilian operation has a short-term, uncommitted line of credit. The interest rate on this line of

credit varies based upon the local prevailing interest rates at the time of borrowing. The interest rate

averaged approximately 15% and 19% during 2007 and 2006, respectively. As of December 31, 2007 and

2006, there were no amounts outstanding under the credit facility.

Other

Total cash paid for interest on the debt facilities amounted to $12.6 million, $12.7 million and $10.8 million in

2007, 2006 and 2005, respectively.

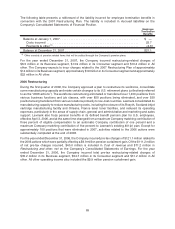

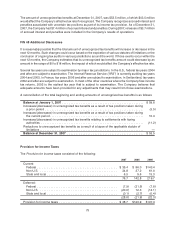

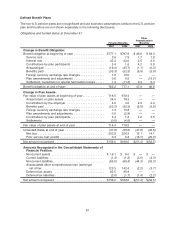

The components of Interest (income) expense, net in the Consolidated Statements of Earnings were as

follows:

2007 2006 2005

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(34.2) $(34.2) $(37.7)

Interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.0 12.1 11.2

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(21.2) $(22.1) $(26.5)

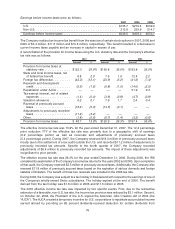

11. INCOME TAXES

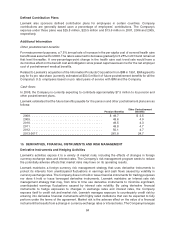

Adoption of FIN 48

The Company adopted the provisions of FIN 48 and related guidance on January 1, 2007. As a result of the

implementation of FIN 48, the Company reduced its liability for unrecognized tax benefits and related

interest and penalties by $7.3 million, which resulted in a corresponding increase in the Company’s

January 1, 2007, retained earnings balance. The Company also recorded an increase in its deferred tax

assets of $8.5 million and a corresponding increase in its liability for unrecognized tax benefits as a result of

adopting FIN 48.

74