Lexmark 2007 Annual Report Download - page 86

Download and view the complete annual report

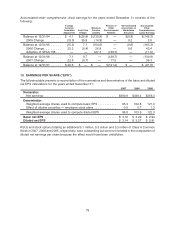

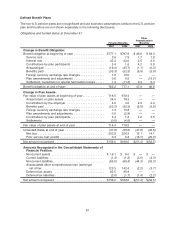

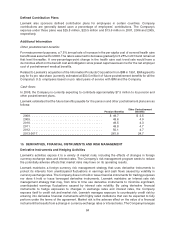

Please find page 86 of the 2007 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14. PENSION AND OTHER POSTRETIREMENT PLANS

Lexmark and its subsidiaries have defined benefit and defined contribution pension plans that cover

certain of its regular employees, and a supplemental plan that covers certain executives. Medical, dental

and life insurance plans for retirees are provided by the Company and certain of its non-U.S. subsidiaries.

Effective April 3, 2006, Lexmark froze pension benefits in its defined benefit pension plan for

U.S. employees and at the same time changed from a maximum Company matching contribution of

three percent of eligible compensation to an automatic Company contribution of one percent and a

maximum Company matching contribution of five percent to Lexmark’s existing 401(k) plan. As a result,

during 2006, the Company recognized a $9.9 million pension curtailment gain due to the freeze of benefit

accruals in the U.S. Additionally, in 2006 and 2007, the Company made a maximum Company matching

contribution of six percent to a nonqualified deferred compensation plan on compensation amounts in

excess of IRS qualified plan limits.

Effective December 31, 2006, the Company adopted SFAS No. 158, Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and

132(R) (“SFAS 158”). SFAS 158 required recognition of the funded status of a benefit plan in the statement

of financial position and recognition in other comprehensive earnings of certain gains and losses that arise

during the period, but are deferred under pension accounting rules.

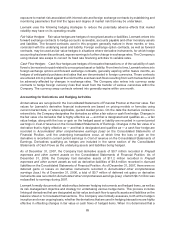

The Pension Protection Act of 2006 (“the Act”) was enacted on August 17, 2006. Most of its provisions will

become effective in 2008. The Act significantly changes the funding requirements for single-employer

defined benefit pension plans. The funding requirements will now largely be based on a plan’s calculated

funded status, with faster amortization of any shortfalls or surpluses. The Act directs the U.S. Treasury

Department to develop a new yield curve to discount pension obligations for determining the funded status

of a plan when calculating the funding requirements.

80