Kohl's 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

7. Stock-Based Compensation

We currently grant share-based compensation pursuant to the Kohl’s Corporation 2010 Long-Term

Compensation Plan, which provides for the granting of various forms of equity-based awards, including

nonvested stock and options to purchase shares of our common stock, to officers, key employees and directors.

As of January 28, 2012, there were 18.5 million shares authorized and 16.1 million shares available for grant

under the 2010 Long-Term Compensation Plan. Options and nonvested stock that are surrendered or terminated

without issuance of shares are available for future grants.

Annual grants of stock options and nonvested stock are made in the first quarter of the subsequent fiscal

year. Grants to newly-hired and promoted employees and other discretionary grants are made periodically

throughout the remainder of the year. We also have outstanding options which were granted under previous

compensation plans.

Stock options

The majority of stock options granted to employees since 2009 vest in five equal annual installments and the

majority of stock options granted to employees prior to 2009 vest in four equal annual installments. Outside

directors’ stock options are typically granted upon a director’s election or re-election to our Board of Directors

and vest over the term to which the director was elected, generally one year. Outstanding options granted to

employees after 2005 have a term of seven years. Outstanding options granted to employees prior to 2006 have a

term of up to 15 years. Options granted to directors have a term of 10 years.

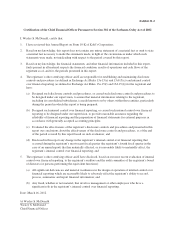

All stock options have an exercise price equal to the fair market value of the common stock on the date of

grant. The fair value of each option award is estimated using a Black-Scholes option valuation model and the

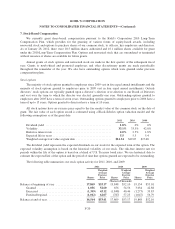

following assumptions as of the grant date:

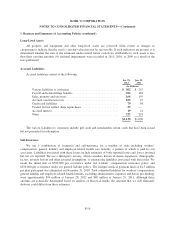

2011 2010 2009

Dividend yield ............................................. 1.8% 0% 0%

Volatility .................................................. 33.1% 33.5% 42.8%

Risk-free interest rate ........................................ 2.0% 2.3% 1.8%

Expected life in years ........................................ 5.5 5.5 5.4

Weighted average fair value at grant date ........................ $14.54 $19.07 $17.68

The dividend yield represents the expected dividends on our stock for the expected term of the option. The

expected volatility assumption is based on the historical volatility of our stock. The risk-free interest rate for

periods within the life of the option is based on a blend of U.S. Treasury bond rates. We use historical data to

estimate the expected life of the option and the period of time that options granted are expected to be outstanding.

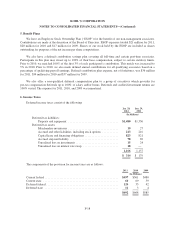

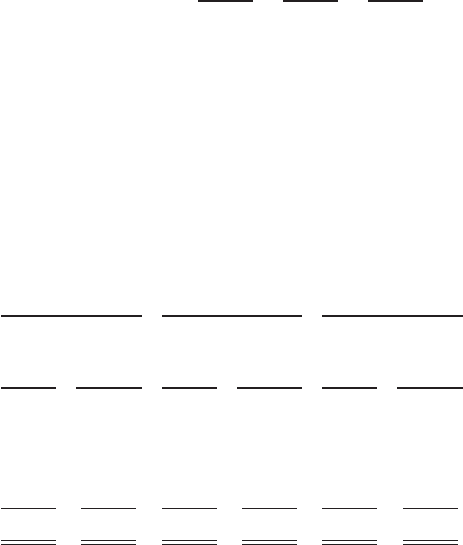

The following table summarizes our stock option activity for 2011, 2010, and 2009:

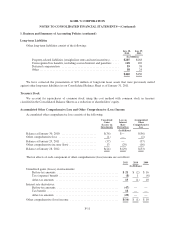

2011 2010 2009

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

(Shares in Thousands)

Balance at beginning of year ................... 17,869 $53.17 19,848 $52.10 19,134 $53.01

Granted ................................ 1,056 52.60 656 54.56 3,034 42.88

Exercised ............................... (1,349) 43.12 (1,848) 40.46 (1,273) 39.83

Forfeited/expired ......................... (1,012) 62.07 (787) 57.25 (1,047) 56.79

Balance at end of year ......................... 16,564 $53.41 17,869 $53.17 19,848 $52.10

F-20