Kohl's 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. Business and Summary of Accounting Policies (continued)

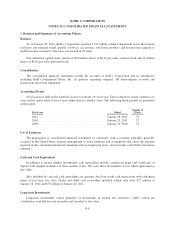

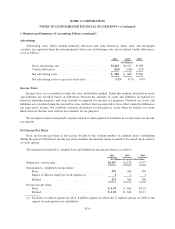

Advertising

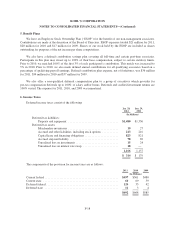

Advertising costs, which include primarily television and radio broadcast, direct mail, and newspaper

circulars, are expensed when the advertisement is first seen. Advertising costs, net of related vendor allowances,

were as follows:

2011 2010 2009

(In Millions)

Gross advertising costs ............................... $1,123 $1,017 $ 988

Vendor allowances ................................... (161) (148) (142)

Net advertising costs ................................. $ 962 $ 869 $ 846

Net advertising costs as a percent of net sales .............. 5.1% 4.7% 4.9%

Income Taxes

Income taxes are accounted for under the asset and liability method. Under this method, deferred tax assets

and liabilities are recorded based on differences between the amounts of assets and liabilities recognized for

financial reporting purposes and such amounts recognized for income tax purposes. Deferred tax assets and

liabilities are calculated using the enacted tax rates and laws that are expected to be in effect when the differences

are expected to reverse. We establish valuation allowances for deferred tax assets when we believe it is more

likely than not that the asset will not be realizable for tax purposes.

We recognize interest and penalty expense related to unrecognized tax benefits in our provision for income

tax expense.

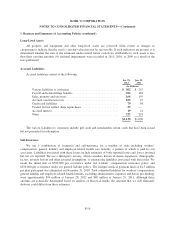

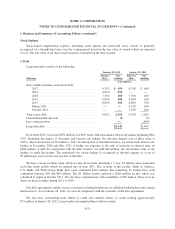

Net Income Per Share

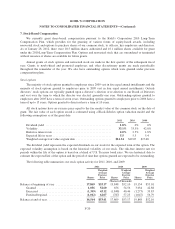

Basic net income per share is net income divided by the average number of common shares outstanding

during the period. Diluted net income per share includes incremental shares assumed to be issued upon exercise

of stock options.

The information required to compute basic and diluted net income per share is as follows:

2011 2010 2009

(In Millions except per share data)

Numerator—net income ................................ $1,167 $1,120 $ 973

Denominator—weighted average shares

Basic ........................................... 270 304 305

Impact of dilutive employee stock options (a) ........... 121

Diluted ......................................... 271 306 306

Net income per share:

Basic ........................................... $ 4.33 $ 3.69 $3.19

Diluted ......................................... $ 4.30 $ 3.66 $3.17

(a) Excludes 11 million options for 2011, 8 million options for 2010 and 17 million options for 2009 as the

impact of such options was antidilutive.

F-14