Kohl's 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SG&A for 2010 increased $239 million, or 6%, over 2009, but decreased as a percentage of net sales.

SG&A increased primarily due to store growth, higher sales, and investments in technology and infrastructure

related to our E-Commerce business.

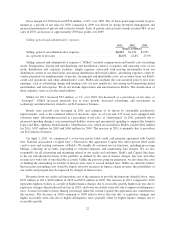

Depreciation and amortization.

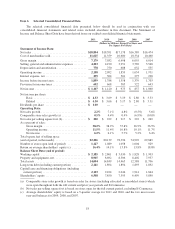

2011 2010 2009

(In Millions)

Depreciation and amortization ..................................... $778 $750 $688

The increases in depreciation and amortization are primarily due to the addition of new stores, remodels and

the opening of our third E-Commerce fulfillment center in Edgewood, Maryland.

Operating income.

2011 2010 2009

(Dollars in Millions)

Operating income ........................................... $2,158 $2,092 $1,859

As a percent of net sales ...................................... 11.5% 11.4% 10.8%

The changes in operating income and operating income as a percent of net sales are due to the factors

discussed above.

Interest expense.

2011 2010 2009

(In Millions)

Interest expense, net ............................................. $299 $304 $301

Net interest expense for 2011 decreased $5 million, or 2%, from 2010. The decrease is attributable to the

repayment of debt totaling $400 million in March and October 2011 and the subsequent issuance of $650 million

of debt in October 2011 at a lower interest rate. Net interest expense for 2010 increased $3 million over 2009.

The increase was primarily attributed to interest on new financing obligations related to new stores.

Income taxes.

2011 2010 2009

(Dollars in Millions)

Provision for income taxes ....................................... $692 $668 $585

Effective tax rate .............................................. 37.2% 37.4% 37.5%

The effective tax rate for 2011 was comparable to the 2010 and 2009 tax rates.

Inflation

Although we expect that our operations will be influenced by general economic conditions, including rising

food, fuel and energy prices, we do not believe that inflation has had a material effect on our results of

operations. However, there can be no assurance that our business will not be affected by such factors in the

future. We experienced 10 – 15% increases in apparel costs in 2011. We expect to see modest increases in the

first six months of 2012, but to see decreases in the last six months of the year.

23