Kohl's 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

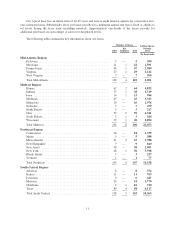

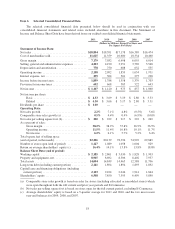

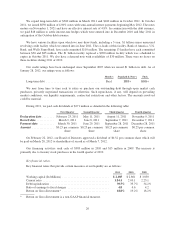

Item 6. Selected Consolidated Financial Data

The selected consolidated financial data presented below should be read in conjunction with our

consolidated financial statements and related notes included elsewhere in this document. The Statement of

Income and Balance Sheet Data have been derived from our audited consolidated financial statements.

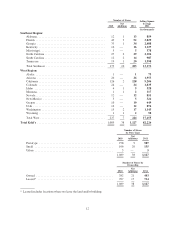

2011 2010 2009 2008 2007

(Dollars in Millions, Except Per Share and

Per Square Foot Data)

Statement of Income Data:

Net sales ..................................... $18,804 $18,391 $17,178 $16,389 $16,474

Cost of merchandise sold ........................ 11,625 11,359 10,680 10,334 10,460

Gross margin ................................. 7,179 7,032 6,498 6,055 6,014

Selling, general and administrative expenses ......... 4,243 4,190 3,951 3,769 3,548

Depreciation and amortization .................... 778 750 688 632 535

Operating income .............................. 2,158 2,092 1,859 1,654 1,931

Interest expense, net ............................ 299 304 301 275 228

Income before income taxes ...................... 1,859 1,788 1,558 1,379 1,703

Provision for income taxes ....................... 692 668 585 522 643

Net income ................................... $ 1,167 $ 1,120 $ 973 $ 857 $ 1,060

Net income per share:

Basic .................................... $ 4.33 $ 3.69 $ 3.19 $ 2.80 $ 3.33

Diluted .................................. $ 4.30 $ 3.66 $ 3.17 $ 2.80 $ 3.31

Dividends per share ............................ $ 1.00 ————

Operating Data:

Net sales growth ............................... 2.2% 7.1% 4.8% (0.5%) 5.6%

Comparable store sales growth (a) ................. 0.5% 4.4% 0.4% (6.9%) (0.8)%

Net sales per selling square foot (b) ................ $ 220 $ 222 $ 217 $ 222 $ 249

As a percent of sales:

Gross margin ............................. 38.2% 38.2% 37.8% 36.9% 36.5%

Operating income .......................... 11.5% 11.4% 10.8% 10.1% 11.7%

Net income ............................... 6.2% 6.1% 5.7% 5.2% 6.4%

Total square feet of selling space

(end of period, in thousands) ..................... 82,226 80,139 78,396 74,992 69,889

Number of stores open (end of period) ............. 1,127 1,089 1,058 1,004 929

Return on average shareholders’ equity (c) .......... 16.4% 14.1% 13.8% 13.8% 18.8%

Balance Sheet Data (end of period):

Working capital ............................... $ 2,185 $ 2,861 $ 3,030 $ 1,828 $ 1,903

Property and equipment, net ...................... 8,905 8,692 8,506 8,402 7,937

Total assets ................................... 14,094 14,849 14,465 12,588 11,796

Long-term debt (including current portion) .......... 2,141 1,894 1,894 1,893 1,892

Capital lease and financing obligations (including

current portion) .............................. 2,103 2,104 2,046 1,914 1,864

Shareholders’ equity ............................ 6,508 7,850 7,595 6,499 5,890

(a) Comparable store sales growth is based on sales for stores (including relocated or remodeled stores) which

were open throughout both the full current and prior year periods and E-Commerce.

(b) Net sales per selling square foot is based on stores open for the full current period, excluding E-Commerce.

(c) Average shareholders’ equity is based on a 5-quarter average for 2011 and 2010, and the two most recent

year-end balances for 2009, 2008, and 2007.

18