Kohl's 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

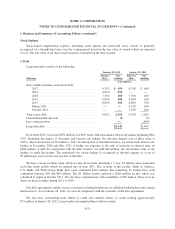

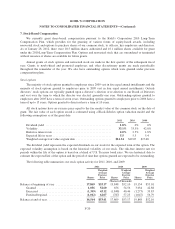

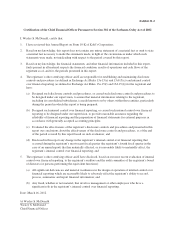

6. Income Taxes (continued)

The provision for income taxes differs from the amount that would be provided by applying the statutory

U.S. corporate tax rate due to the following items:

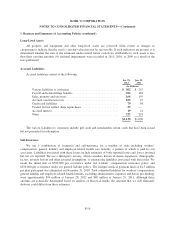

2011 2010 2009

Provision at statutory rate ........................................... 35.0% 35.0% 35.0

State income taxes, net of federal tax benefit ........................... 2.7 2.7 2.8

Tax-exempt interest income ......................................... —(0.3) (0.3)

Federal HIRE Act tax credit ......................................... (0.4) ——

Other Federal tax credits ........................................... (0.1) ——

Provision for income taxes .......................................... 37.2% 37.4% 37.5

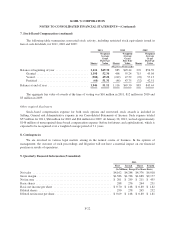

We have analyzed filing positions in all of the federal and state jurisdictions where we are required to file

income tax returns, as well as all open tax years in these jurisdictions. The only federal returns subject to

examination are for the 2008 through 2011 tax years. State returns subject to examination vary depending upon

the state. Generally, the 2008 through 2011 tax years are subject to state examination; however, in some

instances, earlier periods are presently being audited. The earliest open period is 2002. Certain states have

proposed adjustments which we are currently appealing. If we do not prevail on our appeals, we do not anticipate

that the adjustments would result in a material change in our financial position.

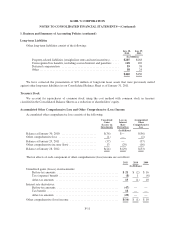

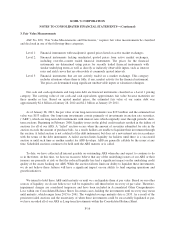

A reconciliation of the beginning and ending gross amount of unrecognized tax benefits is as follows:

2011 2010

(In Millions)

Balance at beginning of year ...................................... $96 $89

Increases due to:

Tax positions taken in prior years .............................. 8—

Tax positions taken in current year ............................. 24 25

Decreases due to:

Tax positions taken in prior years .............................. (9) (9)

Settlements with taxing authorities ............................. (12) (4)

Lapse of applicable statute of limitations ........................ (6) (5)

Balance at end of year ........................................... $101 $96

Not included in the unrecognized tax benefits reconciliation above are gross unrecognized accrued interest

and penalties of $17 million at January 28, 2012 and $24 million at January 29, 2011. Interest and penalty

expense was $4 million for 2011 and $7 million for 2010.

Our total unrecognized tax benefits that, if recognized, would affect our effective tax rate were $69 million

as of January 28, 2012 and $64 million as of January 29, 2011.

It is reasonably possible that our unrecognized tax positions may change within the next 12 months,

primarily as a result of ongoing audits. While it is possible that one or more of these examinations may be

resolved in the next year, it is not anticipated that a significant impact to the unrecognized tax benefit balance

will occur.

F-19