Kohl's 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. Business and Summary of Accounting Policies (continued)

Long-Lived Assets

All property and equipment and other long-lived assets are reviewed when events or changes in

circumstances indicate that the asset’s carrying value may not be recoverable. If such indicators are present, it is

determined whether the sum of the estimated undiscounted future cash flows attributable to such assets is less

than their carrying amounts. No material impairments were recorded in 2011, 2010, or 2009 as a result of the

tests performed.

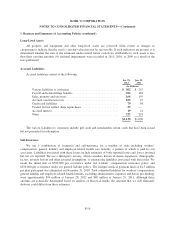

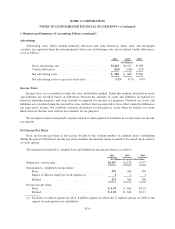

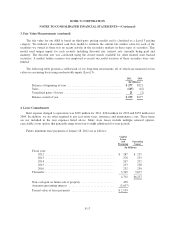

Accrued Liabilities

Accrued liabilities consist of the following:

Jan. 28,

2012

Jan. 29,

2011

(In Millions)

Various liabilities to customers ................................. $ 302 $ 267

Payroll and related fringe benefits .............................. 202 184

Sales, property and use taxes ................................... 166 159

Accrued construction costs .................................... 105 97

Credit card liabilities ......................................... 79 84

Traded, but not settled, share repurchases ........................ 25 —

Accrued interest ............................................. 19 21

Other ..................................................... 232 218

$1,130 $1,030

The various liabilities to customers include gift cards and merchandise return cards that have been issued

but not presented for redemption.

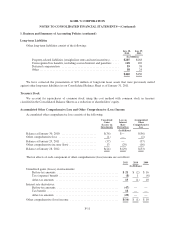

Self-Insurance

We use a combination of insurance and self-insurance for a number of risks including workers’

compensation, general liability and employee-related health care benefits, a portion of which is paid by our

associates. Liabilities associated with these losses include estimates of both reported losses and losses incurred

but not yet reported. We use a third-party actuary, which considers historical claims experience, demographic

factors, severity factors and other actuarial assumptions, to estimate the liabilities associated with these risks. We

retain the initial risk of $500,000 per occurrence under our workers’ compensation insurance policy and

$250,000 per occurrence under our general liability policy. The lifetime medical payment limit of $1.5 million

per plan participant was eliminated on December 31, 2010. Total estimated liabilities for workers’ compensation,

general liability and employee-related health benefits, excluding administrative expenses and before pre-funding,

were approximately $94 million at January 28, 2012 and $89 million at January 29, 2011. Although these

amounts are actuarially determined based on analysis of historical trends, the amounts that we will ultimately

disburse could differ from these estimates.

F-10