Kohl's 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

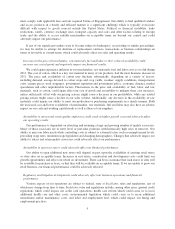

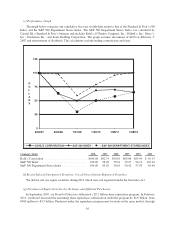

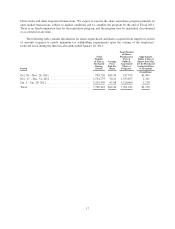

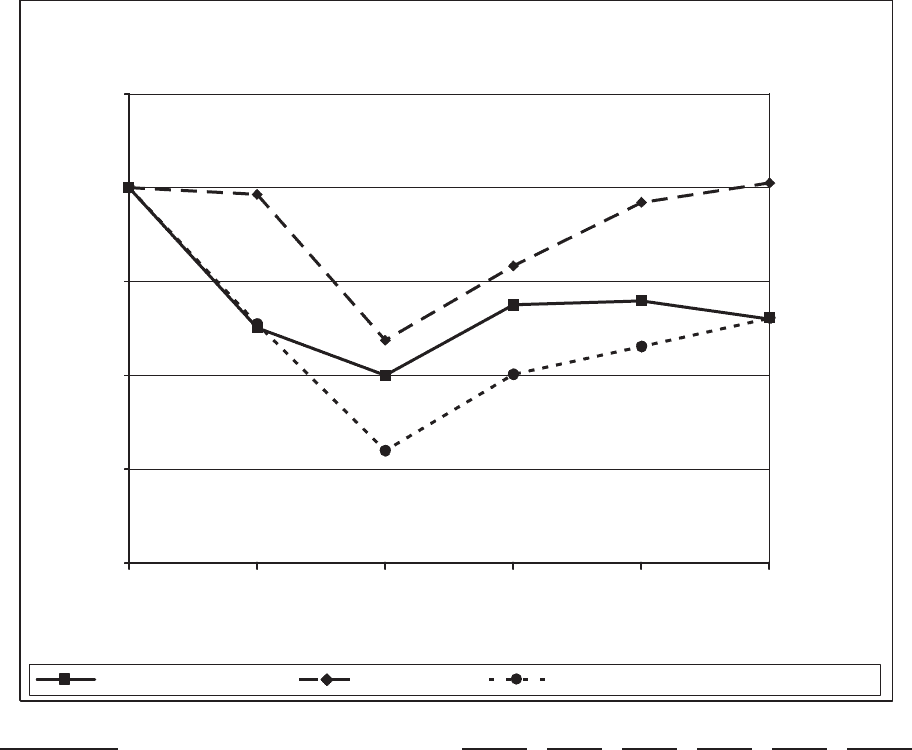

(e) Performance Graph

The graph below compares our cumulative five-year stockholder return to that of the Standard & Poor’s 500

Index and the S&P 500 Department Stores Index. The S&P 500 Department Stores Index was calculated by

Capital IQ, a Standard & Poor’s business and includes Kohl’s; JCPenney Company, Inc.; Dillard’s, Inc.; Macy’s,

Inc.; Nordstrom Inc.; and Sears Holding Corporation. The graph assumes investment of $100 on February 3,

2007 and reinvestment of dividends. The calculations exclude trading commissions and taxes.

0

50

75

25

100

125

2/03/07 2/02/08 1/28/12

1/31/09 1/29/111/30/10

D

O

L

L

A

R

S

KOHL'S CORPORATION S&P 500 INDEX S&P 500 DEPARTMENT STORES INDEX

Company / Index 2006 2007 2008 2009 2010 2011

Kohl’s Corporation ............................ $100.00 $62.79 $50.18 $68.86 $69.99 $ 65.13

S&P 500 Index ............................... 100.00 98.20 59.54 79.27 96.12 101.24

S&P 500 Department Stores Index ................ 100.00 63.85 30.16 50.42 57.83 65.40

(f) Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities during 2011 which were not registered under the Securities Act.

(g) Purchases of Equity Securities by the Issuer and Affiliated Purchasers

In September 2007, our Board of Directors authorized a $2.5 billion share repurchase program. In February

2011, our Board increased the remaining share repurchase authorization under the program by $2.6 billion, from

$900 million to $3.5 billion. Purchases under the repurchase program may be made in the open market, through

16