Kohl's 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

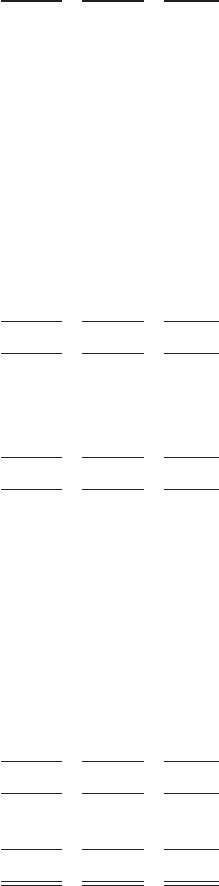

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Millions)

2011 2010 2009

Operating activities

Net income .......................................................... $ 1,167 $ 1,120 $ 973

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ...................................... 778 750 688

Share-based compensation ......................................... 57 66 64

Deferred income taxes ............................................. 144 39 40

Other non-cash revenues and expenses ................................ 41 38 38

Changes in operating assets and liabilities:

Merchandise inventories ....................................... (158) (107) (119)

Other current and long-term assets ............................... (42) (50) (13)

Accounts payable ............................................. 96 (50) 306

Accrued and other long-term liabilities ............................ 61 13 235

Income taxes ................................................ (1) (63) 74

Net cash provided by operating activities .................................. 2,143 1,756 2,286

Investing activities

Acquisition of property and equipment .................................... (927) (801) (675)

Sales of investments in auction rate securities .............................. 145 42 28

Other .............................................................. (20) 2 (2)

Net cash used in investing activities ...................................... (802) (757) (649)

Financing activities

Treasury stock purchases ............................................... (2,311) (1,004) (1)

Long-term debt payments .............................................. (400) ——

Capital lease and financing obligation payments ............................ (91) (84) (70)

Proceeds from financing obligations ...................................... 14 27 10

Proceeds from issuance of debt .......................................... 646 ——

Interest rate hedge payment ............................................. (48) ——

Deferred financing costs ............................................... (8) ——

Proceeds from stock option exercises ..................................... 58 75 51

Dividends paid ....................................................... (271) ——

Other .............................................................. (2) (3) (3)

Net cash used in financing activities ...................................... (2,413) (989) (13)

Net (decrease) increase in cash and cash equivalents ......................... (1,072) 10 1,624

Cash and cash equivalents at beginning of year ............................. 2,277 2,267 643

Cash and cash equivalents at end of year .................................. $ 1,205 $ 2,277 $2,267

Supplemental information:

Interest paid, net of capitalized interest ................................ $ 297 $ 304 $ 300

Income taxes paid ................................................ 550 689 470

Non-cash investing and financing activities

Property and equipment acquired through capital lease and financing

obligations .................................................... $79$ 107 $ 183

See accompanying Notes to Consolidated Financial Statements

F-7