Kohl's 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. Business and Summary of Accounting Policies (continued)

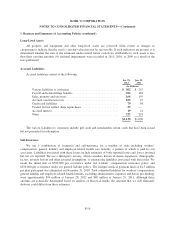

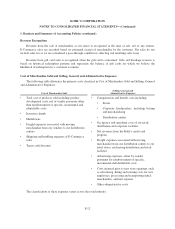

Long-term Liabilities

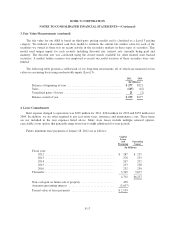

Other long-term liabilities consist of the following:

Jan. 28,

2012

Jan. 29,

2011

(In Millions)

Property-related liabilities (straight-line rents and rent incentives) ...... $285 $268

Unrecognized tax benefits, including accrued interest and penalties .... 118 120

Deferred compensation ....................................... 39 38

Other ...................................................... 18 24

$460 $450

We have corrected the presentation of $70 million of long-term lease assets that were previously netted

against other long-term liabilities in our Consolidated Balance Sheet as of January 31, 2011.

Treasury Stock

We account for repurchases of common stock using the cost method with common stock in treasury

classified in the Consolidated Balance Sheets as a reduction of shareholders’ equity.

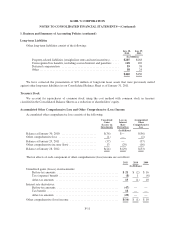

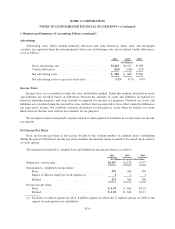

Accumulated Other Comprehensive Loss and Other Comprehensive (Loss) Income

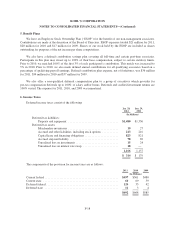

Accumulated other comprehensive loss consists of the following:

Unrealized

Gains

(Losses) on

Investments

Loss on

Interest

Rate

Derivatives

Accumulated

Other

Comprehensive

Loss

(In Millions)

Balance at January 30, 2010 ........................ $(36) $— $(36)

Other comprehensive loss .......................... (1) — (1)

Balance at January 29, 2011 ........................ (37) — (37)

Other comprehensive income (loss) ................... 13 (29) (16)

Balance at January 28, 2012 ........................ $(24) $ (29) $(53)

The tax effects of each component of other comprehensive (loss) income are as follows:

2011 2010 2009

(In Millions)

Unrealized gains (losses) on investments:

Before-tax amounts .......................................... $21 $ (2) $ 16

Tax (expense) benefit ......................................... (8) 1 (6)

After-tax amounts ........................................... 13 (1) 10

Interest rate derivatives:

Before-tax amounts .......................................... (47) ——

Tax benefit ................................................. 18 ——

After-tax amounts ........................................... (29) ——

Other comprehensive (loss) income ................................. $(16) $ (1) $ 10

F-11