Kohl's 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. Business and Summary of Accounting Policies (continued)

Revenue Recognition

Revenue from the sale of merchandise at our stores is recognized at the time of sale, net of any returns.

E-Commerce sales are recorded based on estimated receipt of merchandise by the customer. Net sales do not

include sales tax as we are considered a pass-through conduit for collecting and remitting sales taxes.

Revenue from gift card sales is recognized when the gift card is redeemed. Gift card breakage revenue is

based on historical redemption patterns and represents the balance of gift cards for which we believe the

likelihood of redemption by a customer is remote.

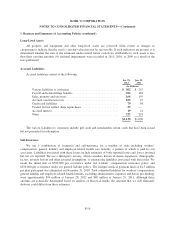

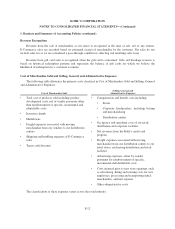

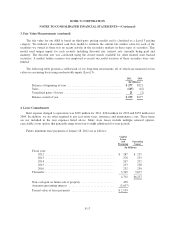

Cost of Merchandise Sold and Selling, General and Administrative Expenses

The following table illustrates the primary costs classified in Cost of Merchandise Sold and Selling, General

and Administrative Expenses:

Cost of Merchandise Sold

Selling, General and

Administrative Expenses

• Total cost of products sold including product

development costs, net of vendor payments other

than reimbursement of specific, incremental and

identifiable costs

• Inventory shrink

• Markdowns

• Freight expenses associated with moving

merchandise from our vendors to our distribution

centers

• Shipping and handling expenses of E-Commerce

sales

• Terms cash discount

• Compensation and benefit costs including:

• Stores

• Corporate headquarters, including buying

and merchandising

• Distribution centers

• Occupancy and operating costs of our retail,

distribution and corporate facilities

• Net revenues from the Kohl’s credit card

program

• Freight expenses associated with moving

merchandise from our distribution centers to our

retail stores, and among distribution and retail

facilities

• Advertising expenses, offset by vendor

payments for reimbursement of specific,

incremental and identifiable costs

• Costs incurred prior to new store openings, such

as advertising, hiring and training costs for new

employees, processing and transporting initial

merchandise, and rent expense

• Other administrative costs

The classification of these expenses varies across the retail industry.

F-12