Kohl's 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Rock & Republic was launched in February 2012. Kohl’s is the exclusive US retailer of Rock &

Republic apparel, accessories and all other merchandise.

• Van Heusen was introduced into our men’s sportswear, dress shirt and accessories departments in

February 2012.

• Two of our most successful brands—ELLE and Simply Vera Vera Wang—will expand into new

categories in Spring 2012. ELLE will expand into both fashion jewelry and beauty and Simply Vera

Vera Wang will expand into cosmetics.

• In December, we announced the launch of Princess Vera Wang, a junior’s contemporary, premium

lifestyle collection which will be available exclusively in Kohl’s stores nationwide and through

Kohls.com beginning August 2012.

The success of our recently-launched brands, as well as the growth of our other exclusive and private brands,

continue to drive increased penetration of our exclusive and private brand sales as a percentage of total sales.

This penetration increased approximately 240 basis points to 50.3% for 2011.

In-Store Shopping Experience

Practical, easy shopping is about convenience. At Kohl’s, convenience includes a neighborhood location

close to home, convenient parking, easily accessible entry, knowledgeable and friendly associates, wide aisles, a

functional store layout, shopping carts/strollers and fast, centralized checkouts. Though our stores have fewer

departments than traditional, full-line department stores, the physical layout of the store and our focus on strong

in-stock positions in style, color and size is aimed at providing a convenient shopping experience for an

increasingly time-starved customer.

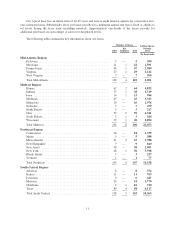

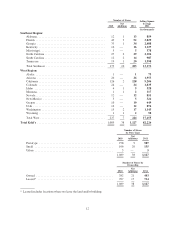

At the time of our initial public offering in 1992, we had 79 stores in the Midwest. As of year-end 2011, we

operated 1,127 stores. We have stores in 49 states and in every large and intermediate sized market in the United

States.

2010 Increase 2011

Number of stores ............................................. 1,089 38 1,127

Gross square footage (in millions) ................................ 96 2 98

Retail selling square footage (in millions) .......................... 80 2 82

Though our expansion rate has slowed in recent years, our new store program continues to target profitable

growth opportunities. We expect to increase our store count by approximately 20 stores in fiscal 2012,

Substantially all of the 2012 stores will be small stores (55,000 to 68,000 square feet). We plan to continue to

focus our future expansion efforts on opportunistic acquisitions as well as fill-in stores in our better performing

markets.

Remodels are also an important part of our in-store shopping experience initiatives as we believe it is

extremely important to maintain our existing store base. We completed 100 store remodels in 2011, 85 in 2010

and 51 in 2009. We currently plan to remodel approximately 50 stores in 2012. We have effectively compressed

the remodel duration period which minimizes costs and disruption to our stores and benefits our sales and

customer experience. We expect a typical remodel in 2012 will take seven weeks; a reduction of approximately

50 percent since 2007.

We remain focused on providing the solid infrastructure needed to ensure consistent, low-cost execution.

We proactively invest in distribution capacity and regional management to facilitate growth in new and existing

markets as well as online. Our central merchandising organization tailors merchandise assortments to reflect

regional climates and preferences. Management information systems support our low-cost culture by enhancing

productivity and providing the information needed to make key merchandising decisions.

4