Kohl's 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

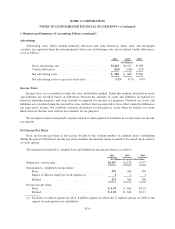

3. Fair Value Measurements (continued)

The fair value for our ARS is based on third-party pricing models and is classified as a Level 3 pricing

category. We utilized a discounted cash flow model to estimate the current fair market value for each of the

securities we owned as there was no recent activity in the secondary markets in these types of securities. This

model used unique inputs for each security including discount rate, interest rate currently being paid and

maturity. The discount rate was calculated using the closest match available for other insured asset backed

securities. A market failure scenario was employed as recent successful auctions of these securities were very

limited.

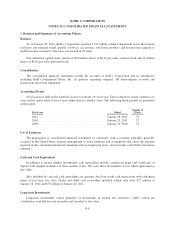

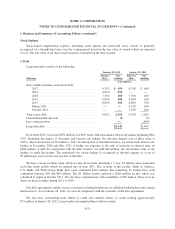

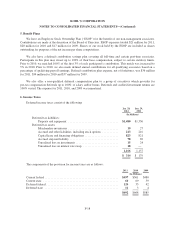

The following table presents a rollforward of our long-term investments, all of which are measured at fair

value on a recurring basis using unobservable inputs (Level 3):

2011 2010

(In Millions)

Balance at beginning of year ..................................... $ 277 $321

Sales ........................................................ (145) (42)

Unrealized gains / (losses) ....................................... 21 (2)

Balance at end of year .......................................... $ 153 $277

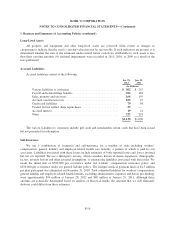

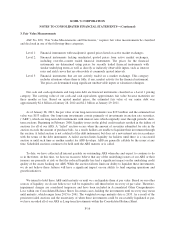

4.Lease Commitments

Rent expense charged to operations was $265 million for 2011, $264 million for 2010 and $253 million for

2009. In addition, we are often required to pay real estate taxes, insurance and maintenance costs. These items

are not included in the rent expenses listed above. Many store leases include multiple renewal options,

exercisable at our option, that generally range from four to eight additional five-year periods.

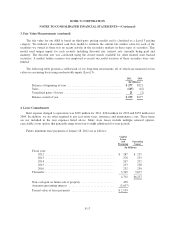

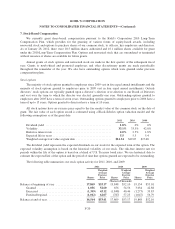

Future minimum lease payments at January 28, 2012 are as follows:

Capital

Lease

and

Financing

Operating

Leases

(In Millions)

Fiscal year:

2012 ............................................... $ 287 $ 235

2013 ............................................... 278 233

2014 ............................................... 267 232

2015 ............................................... 253 230

2016 ............................................... 252 230

Thereafter ............................................... 3,365 5,077

4,702 $6,237

Non-cash gain on future sale of property ...................... 458

Amount representing interest ............................... (3,057)

Present value of lease payments ............................. $2,103

F-17