Kohl's 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. Business and Summary of Accounting Policies (continued)

Vendor Allowances

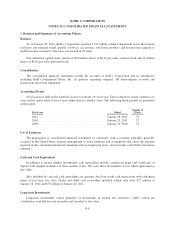

We receive consideration for a variety of vendor-sponsored programs, such as markdown allowances,

volume rebates and promotion and advertising support. The vendor consideration is recorded either as a

reduction of inventory costs or Selling, General and Administrative (“SG&A”) expenses based on the application

of Accounting Standards Codification (“ASC”) No. 605, Subtopic 50, “Customer Payments and Incentives.”

Promotional and advertising allowances are intended to offset our advertising costs to promote vendors’

merchandise. Markdown allowances and volume rebates are recorded as a reduction of inventory costs.

Leases

We lease certain property and equipment used in our operations.

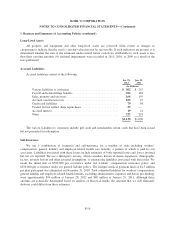

We are often involved extensively in the construction of leased stores. In many cases, we are responsible for

construction cost over runs or non-standard tenant improvements (e.g. roof or HVAC systems). As a result of this

involvement, we are deemed the “owner” for accounting purposes during the construction period, so are required

to capitalize the construction costs on our Balance Sheet. Upon completion of the project, we perform a sale-

leaseback analysis pursuant to ASC 840, “Leases,” to determine if we can remove the assets from our Balance

Sheet. In many of our leases, we are reimbursed a portion of the construction costs via adjusted rental payments

and/or cash payments or have terms which fix the rental payments for a significant percentage of the leased

asset’s economic life. These items generally are considered “continuing involvement” which precludes us from

derecognizing the assets from our Balance Sheet when construction is complete. In conjunction with these leases,

we also record financing obligations equal to the cash proceeds or fair market value of the assets received from

the landlord. At the end of the lease term, including exercise of any renewal options, the net remaining financing

obligation over the net carrying value of the fixed asset will be recognized as a non-cash gain on sale of the

property. We do not report rent expense for the properties which are owned for accounting purposes. Rather,

rental payments under the lease are recognized as a reduction of the financing obligation and interest expense.

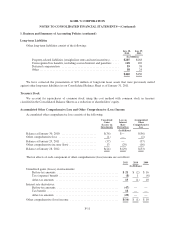

Some of our property and equipment is held under capital leases. These assets are included in property and

equipment and depreciated over the term of the lease. We do not report rent expense for capital leases. Rather,

rental payments under the lease are recognized as a reduction of the capital lease obligation and interest expense.

All other leases are considered operating leases in accordance with ASC 840. Assets subject to an operating

lease and the related lease payments are not recorded on our balance sheet. Rent expense is recognized on a

straight-line basis over the expected lease term.

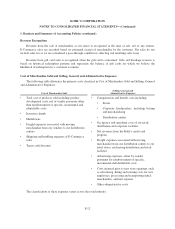

The lease term for all types of leases begins on the date we become legally obligated for the rent payments

or we take possession of the building or land, whichever is earlier. The lease term includes cancelable option

periods where failure to exercise such options would result in an economic penalty. Failure to exercise such

options would result in the recognition of accelerated depreciation expense of the related assets.

F-13