Kohl's 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. Business and Summary of Accounting Policies (continued)

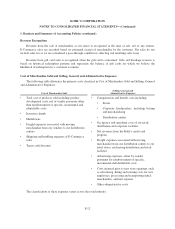

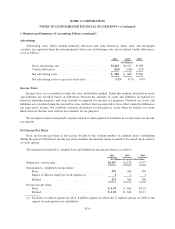

Stock Options

Stock-based compensation expense, including stock options and nonvested stock awards, is generally

recognized on a straight-line basis over the vesting period based on the fair value of awards which are expected

to vest. The fair value of all share-based awards is estimated on the date of grant.

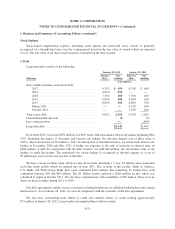

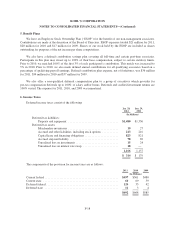

2. Debt

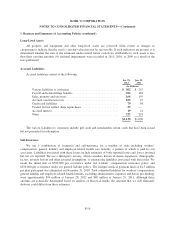

Long-term debt consists of the following:

January 28, 2012 January 29, 2011

Maturing

Effective

Rate

Out-

standing

Effective

Rate

Out-

standing

($ in Millions)

Non-callable and unsecured senior debt:

2017 ....................................... 6.31% $ 650 6.31% $ 650

2021 ....................................... 4.81% 650 ——

2029 ....................................... 7.36% 200 7.36% 200

2033 ....................................... 6.05% 300 6.05% 300

2037 ....................................... 6.89% 350 6.89% 350

March 2011 ................................. — —6.32% 300

October 2011 ................................ — —7.41% 100

Total senior debt ................................. 6.01% 2,150 6.55% 1,900

Unamortized debt discount ......................... (9) (6)

Less current portion ............................... —(400)

Long-term debt .................................. $2,141 $1,494

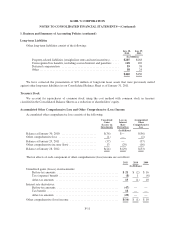

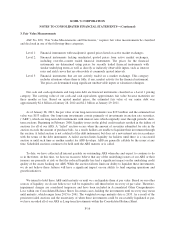

In October 2011, we issued $650 million of 4.00% notes with semi-annual interest payments beginning May

2012. Including the impact of discounts and interest rate hedges, the effective interest rate of these notes is

4.81%. The notes mature on November 1, 2021. In anticipation of this debt issuance, we entered into interest rate

hedges in December 2010 and May 2011 to hedge our exposure to the risk of increases in interest rates on

$400 million of debt. In conjunction with the debt issuance, we paid $48 million, the fair market value of the

hedges, to settle the hedges. The unrealized loss on the hedges is recognized as interest expense at a rate of

$5 million per year over the ten-year life of the debt.

We have various facilities upon which we may draw funds, including a 5-year, $1 billion senior unsecured

revolving credit facility which we entered into in June 2011. The co-leads of this facility, Bank of America,

U.S. Bank, and Wells Fargo Bank, have each committed $110 million. The remaining 13 lenders have each

committed between $30 and $85 million. The $1 billion facility replaced a $900 million facility which was

scheduled to expire in October 2011. We also have a demand note with availability of $30 million. There were no

draws on these facilities during 2011 or 2010.

Our debt agreements contain various covenants including limitations on additional indebtedness and certain

financial tests. As of January 28, 2012, we were in compliance with all covenants of the debt agreements.

We also have outstanding trade letters of credit and stand-by letters of credit totaling approximately

$77 million at January 28, 2012, issued under uncommitted lines with two banks.

F-15