Kohl's 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

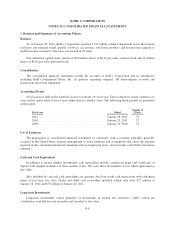

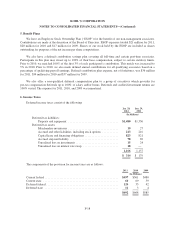

3. Fair Value Measurements

ASC No. 820, “Fair Value Measurements and Disclosures,” requires fair value measurements be classified

and disclosed in one of the following three categories:

Level 1: Financial instruments with unadjusted, quoted prices listed on active market exchanges.

Level 2: Financial instruments lacking unadjusted, quoted prices from active market exchanges,

including over-the-counter traded financial instruments. The prices for the financial

instruments are determined using prices for recently traded financial instruments with

similar underlying terms as well as directly or indirectly observable inputs, such as interest

rates and yield curves that are observable at commonly quoted intervals.

Level 3: Financial instruments that are not actively traded on a market exchange. This category

includes situations where there is little, if any, market activity for the financial instrument.

The prices are determined using significant unobservable inputs or valuation techniques.

Our cash and cash equivalents and long-term debt are financial instruments classified as a Level 1 pricing

category. The carrying value of our cash and cash equivalents approximates fair value because maturities are

three months or less. Based on quoted market prices, the estimated fair value of our senior debt was

approximately $2.4 billion at January 28, 2012 and $2.1 billion at January 29, 2011.

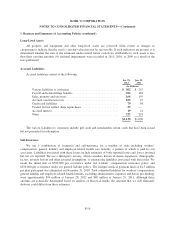

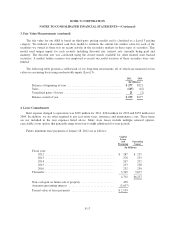

As of January 28, 2012, the par value of our long-term investments was $193 million and the estimated fair

value was $153 million. Our long-term investments consist primarily of investments in auction rate securities,

(“ARS”), which are long-term debt instruments with interest rates which originally reset through periodic short-

term auctions. Beginning in February 2008, liquidity issues in the global credit markets resulted in the failure of

auctions for all of our ARS. A “failed” auction occurs when the amount of securities submitted for sale in the

auction exceeds the amount of purchase bids. As a result, holders are unable to liquidate their investment through

the auction. A failed auction is not a default of the debt instrument, but does set a new interest rate in accordance

with the terms of the debt instrument. A failed auction limits liquidity for holders until there is a successful

auction or until such time as another market for ARS develops. ARS are generally callable by the issuer at any

time. Scheduled auctions continue to be held until the ARS matures or is called.

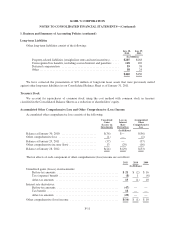

To date, we have collected all interest payable on outstanding ARS when due and expect to continue to do

so in the future. At this time, we have no reason to believe that any of the underlying issuers of our ARS or their

insurers are presently at risk or that the reduced liquidity has had a significant impact on the underlying credit

quality of the assets backing our ARS. While the auction failures limit our ability to liquidate these investments,

we do not believe these failures will have a significant impact on our ability to fund ongoing operations and

growth initiatives.

We intend to hold these ARS until maturity or until we can liquidate them at par value. Based on our other

sources of liquidity, we do not believe we will be required to sell them before recovery of par value. Therefore,

impairment charges are considered temporary and have been included in Accumulated Other Comprehensive

Loss within our Consolidated Balance Sheet. In certain cases, holding the investments until recovery may mean

until maturity, which ranges from 2015 to 2041. The weighted-average maturity date is 2033. As a result of the

persistent failed auctions and the uncertainty of when these investments could be successfully liquidated at par,

we have recorded all of our ARS as Long-term Investments within the Consolidated Balance Sheet.

F-16