Kohl's 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

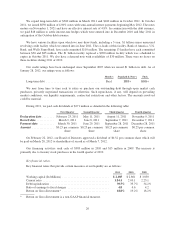

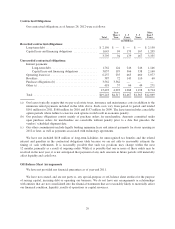

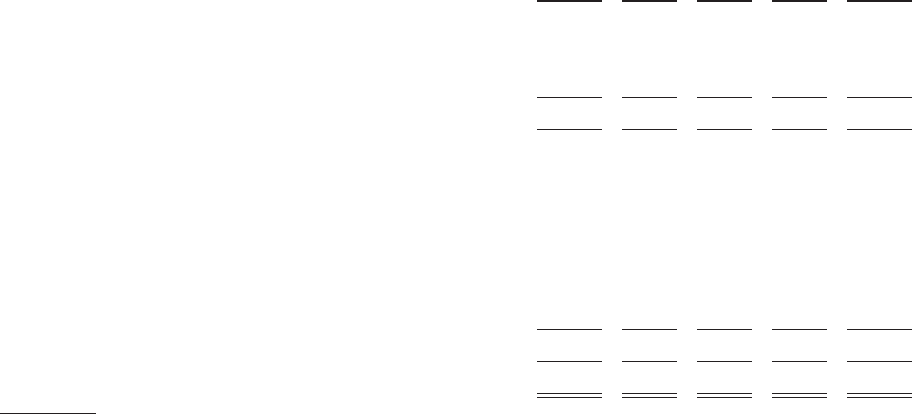

Contractual Obligations

Our contractual obligations as of January 28, 2012 were as follows:

Total

Less

Than 1

Year

1-3

Years

3-5

Years

More

than 5

Years

(In Millions)

Recorded contractual obligations:

Long-term debt ................................... $ 2,150 $ — $ — $ — $ 2,150

Capital lease and financing obligations ................ 1,645 94 179 167 1,205

3,795 94 179 167 3,355

Unrecorded contractual obligations:

Interest payments:

Long-term debt ............................... 1,762 124 246 246 1,146

Capital lease and financing obligations ............ 3,057 193 366 338 2,160

Operating leases (a) ............................... 6,237 235 465 460 5,077

Royalties ........................................ 387 72 145 110 60

Purchase obligations (b) ............................ 3,562 3,562 — — —

Other (c) ........................................ 418 37 66 44 271

15,423 4,223 1,288 1,198 8,714

Total ........................................... $19,218 $4,317 $1,467 $1,365 $12,069

(a) Our leases typically require that we pay real estate taxes, insurance and maintenance costs in addition to the

minimum rental payments included in the table above. Such costs vary from period to period and totaled

$161 million for 2011, $168 million for 2010 and $157 million for 2009. The lease term includes cancelable

option periods where failure to exercise such options would result in economic penalty.

(b) Our purchase obligations consist mainly of purchase orders for merchandise. Amounts committed under

open purchase orders for merchandise are cancelable without penalty prior to a date that precedes the

vendors’ scheduled shipment date.

(c) Our other commitments include legally binding minimum lease and interest payments for stores opening in

2012 or later, as well as payments associated with technology agreements.

We have not included $118 million of long-term liabilities for unrecognized tax benefits and the related

interest and penalties in the contractual obligations table because we are not able to reasonably estimate the

timing of cash settlements. It is reasonably possible that such tax positions may change within the next

12 months, primarily as a result of ongoing audits. While it is possible that one or more of these audits may be

resolved in the next year, it is not anticipated that payment of any such amounts in future periods will materially

affect liquidity and cash flows.

Off-Balance Sheet Arrangements

We have not provided any financial guarantees as of year-end 2011.

We have not created, and are not party to, any special-purpose or off-balance sheet entities for the purpose

of raising capital, incurring debt or operating our business. We do not have any arrangements or relationships

with entities that are not consolidated into the financial statements that are reasonably likely to materially affect

our financial condition, liquidity, results of operations or capital resources.

29