Kohl's 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

5. Benefit Plans

We have an Employee Stock Ownership Plan (“ESOP”) for the benefit of our non-management associates.

Contributions are made at the discretion of the Board of Directors. ESOP expenses totaled $21 million for 2011,

$20 million for 2010 and $17 million for 2009. Shares of our stock held by the ESOP are included as shares

outstanding for purposes of the net income per share computations.

We also have a defined contribution savings plan covering all full-time and certain part-time associates.

Participants in this plan may invest up to 100% of their base compensation, subject to certain statutory limits.

Prior to 2010, we matched 100% of the first 3% of each participant’s contribution. This match was increased to

5% in 2010. Prior to 2010, we also made defined annual contributions for all qualifying associates based on a

percentage of qualifying payroll earnings. Defined contribution plan expense, net of forfeitures, was $36 million

for 2011, $34 million for 2010 and $37 million for 2009.

We also offer a non-qualified deferred compensation plan to a group of executives which provides for

pre-tax compensation deferrals up to 100% of salary and/or bonus. Deferrals and credited investment returns are

100% vested. The expense for 2011, 2010, and 2009 was immaterial.

6. Income Taxes

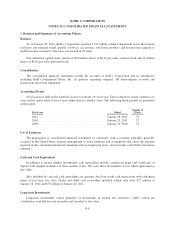

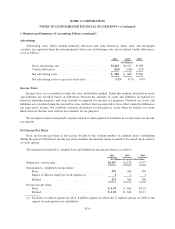

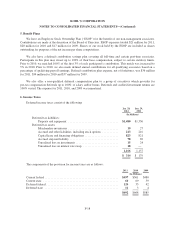

Deferred income taxes consist of the following:

Jan. 28,

2012

Jan. 29,

2011

(In Millions)

Deferred tax liabilities:

Property and equipment .................................. $1,480 $1,336

Deferred tax assets:

Merchandise inventories .................................. 19 27

Accrued and other liabilities, including stock options ........... 213 216

Capital lease and financing obligations ....................... 823 821

Accrued step rent liability ................................. 78 69

Unrealized loss on investments ............................. 15 24

Unrealized loss on interest rate swap ........................ 18 —

1,166 1,157

$ 314 $ 179

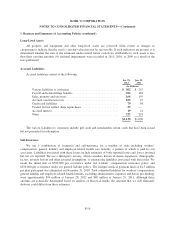

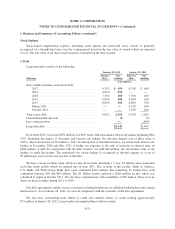

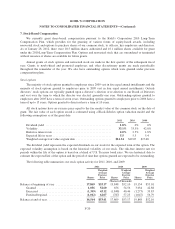

The components of the provision for income taxes are as follows:

2011 2010 2009

(In Millions)

Current federal .................................................. $497 $561 $480

Current state ................................................... 60 69 59

Deferred federal ................................................. 124 35 42

Deferred state .................................................. 11 34

$692 $668 $585

F-18