Kohl's 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Kohl's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KOHL’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

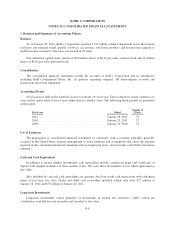

1. Business and Summary of Accounting Policies

Business

As of January 28, 2012, Kohl’s Corporation operated 1,127 family-oriented department stores that feature

exclusive and national brand apparel, footwear, accessories, soft home products and housewares targeted to

middle-income customers. Our stores are located in 49 states.

Our authorized capital stock consists of 800 million shares of $0.01 par value common stock and 10 million

shares of $0.01 par value preferred stock.

Consolidation

The consolidated financial statements include the accounts of Kohl’s Corporation and its subsidiaries

including Kohl’s Department Stores, Inc., its primary operating company. All intercompany accounts and

transactions have been eliminated.

Accounting Period

Our fiscal year ends on the Saturday closest to January 31st each year. Unless otherwise stated, references to

years in this report relate to fiscal years rather than to calendar years. The following fiscal periods are presented

in this report.

Fiscal year Ended

Number of

Weeks

2011 ............................................ January 28, 2012 52

2010 ............................................ January 29, 2011 52

2009 ............................................ January 30, 2010 52

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally

accepted in the United States requires management to make estimates and assumptions that affect the amounts

reported in the consolidated financial statements and accompanying notes. Actual results could differ from those

estimates.

Cash and Cash Equivalents

In addition to money market investments, cash equivalents include commercial paper and certificates of

deposit with original maturities of three months or less. We carry these investments at cost which approximates

fair value.

Also included in cash and cash equivalents are amounts due from credit card transactions with settlement

terms of less than five days. Credit and debit card receivables included within cash were $72 million at

January 28, 2012 and $70 million at January 29, 2011.

Long-term Investments

Long-term investments consist primarily of investments in auction rate securities (“ARS”) which are

classified as available-for-sale securities and recorded at fair value.

F-8