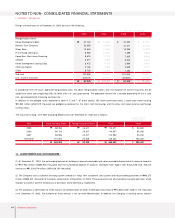

Kia 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 79

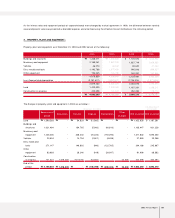

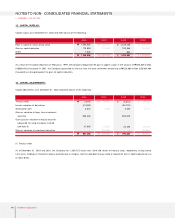

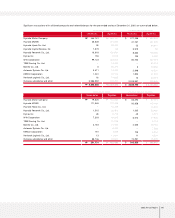

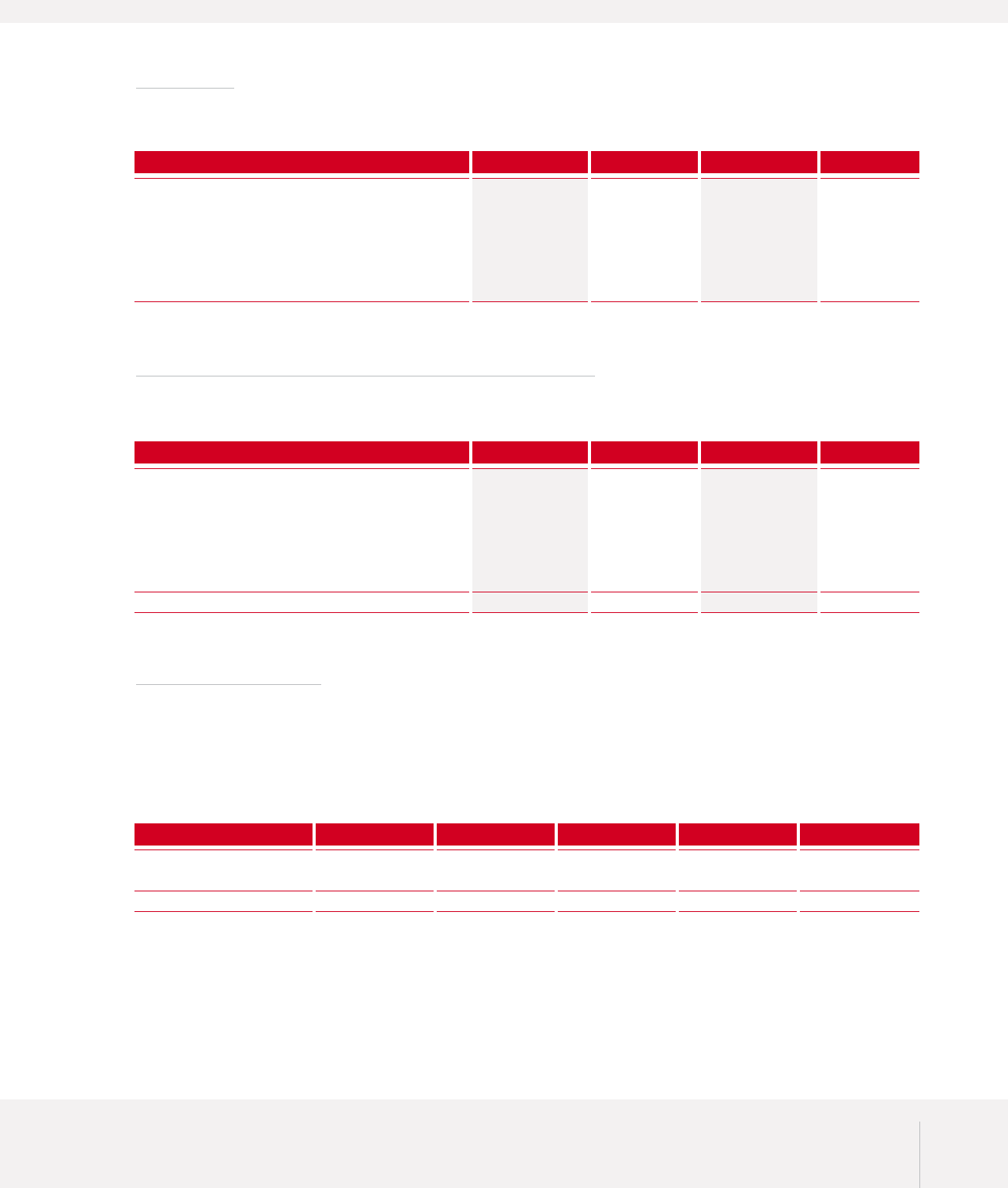

19. DIVIDENDS :

The computation of the proposed dividends in 2003 and 2002 is as follows :

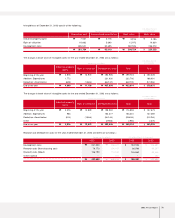

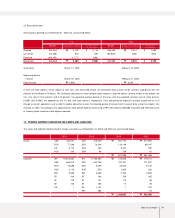

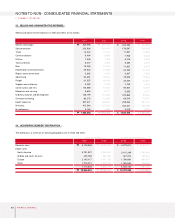

20. SUPPLEM ENTARY INFORM ATION FOR COM PUTATION OF VALUE ADDED :

The accounts and amounts needed for calculation of value added are as follows :

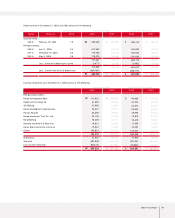

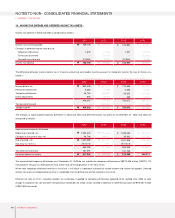

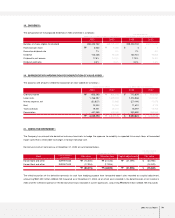

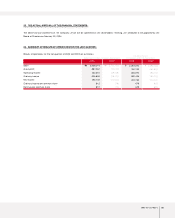

21. DERIVATIVE INSTRUM ENT :

The Company has entered into derivative instrument contracts to hedge the exposure to variability in expected future cash flows of forecasted

export sales that is attributable to changes in foreign exchange rate.

Derivative instrument contracts as of December 31, 2003 are summarized below.

The effective portion of the derivative contracts for cash flow hedging purpose from forecasted export sales recorded as a capital adjustment,

amounting ₩41,599 million (US$34,730 thousand) as of December 31, 2003, all of which were included in the determination of net income in

2004 and the ineffective portion of the derivative contracts recorded in current operations, amounting ₩48,820 million (US$40,758 thousand)

2003 2002 2003 2002

Korean won (in millions, except per share amount) U.S. dollars (Note 2)

(in thousands, except per share amount)

Number of shares eligible for dividend

Face value per share

Face value dividend rate

Dividend

Dividend to net income

Dividend yield ratio

358,420,732

5,000

7%

125,448

17.8%

3.4%

368,121,297

5,000

5%

92,030

14.3%

2.6%

₩₩

358,420,732

4

7%

104,731

17.8%

3.4%

368,121,297

4

5%

76,833

14.3%

2.6%

$$

2003 2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Ordinary income

Labor costs

Interest expense, net

Rent

Taxes and dues

Depreciation

853,599

1,766,597

(32,837)

13,932

19,521

401,958

3,022,770

801,310

1,609,923

13,865

10,984

20,011

423,486

2,879,579

₩

₩

₩

₩

712,639

1,474,868

(27,414)

11,631

16,297

335,580

2,523,601

668,985

1,344,067

11,575

9,170

16,706

353,553

2,404,056

$

$

$

$

Korean won (in millions)

Contract amounts

(in thousand)

U.S. dollars (Note 2)

(in thousands)

Koram Bank and other

Koram Bank and other

EUR 907,000

EUR 907,000

Fair valueBank

(73,025)

(17,394)

(90,419)

Valuation loss Capital adjustments Fair value

(31,426)

(17,394)

(48,820)

₩

₩

₩

₩

(41,599)

-

(41,599)

₩

₩

(60,966)

(14,522)

(75,488)

$

$