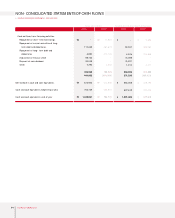

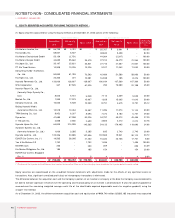

Kia 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 61

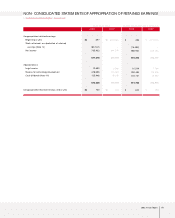

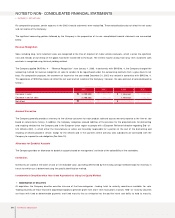

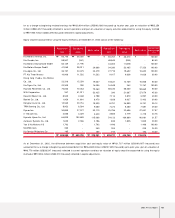

Available-for-sale securities are valued at fair value. However, available-for-sale securities that do not have a quoted market price in an active

market and whose fair value cannot be reliably measured are valued at cost. The difference between the book value and the acquisition cost of

available-for-sale securities, amounting to ₩966,854 million (US$807,192 thousand) as of December 31, 2003, consist of gain on valuation of

long-term investment securities of ₩969,404 million (US$809,320 million) reflected in capital adjustments and an impairment loss of

investment of ₩2,550 million (US$2,129 thousand) in 2002.

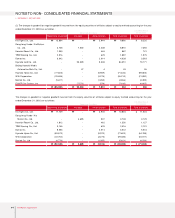

(3) Held-to-maturity securities as of December 31, 2003 consist of the following :

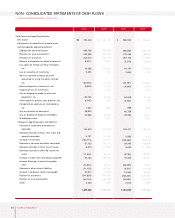

As the interest rates and repayment periods of corporate bonds were changed by mutual agreement in 1999, the difference between nominal

value and present value was presented as bad debt expense, and amortized using the effective interest method over the remaining period.

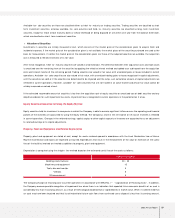

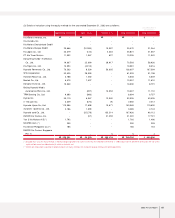

Maturities of held-to-maturity securities are as follows :

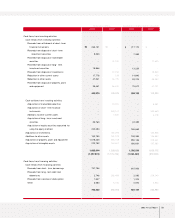

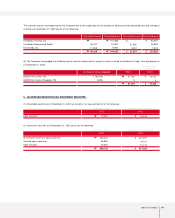

(4) The Company has pledged the following long-term investment securities as collateral for various short-term and long-term borrowings as

of December 31, 2003 :

Acquisition cost Present value discount Book value Book value

Korean won (in millions)

U.S. dollars (Note 2)

(in thousands)

Government and municipal bonds

Corporate bonds:

Acrowave Co., Ltd.

Subordinated bonds:

Seoul Guarantee Insurance Company

10,213

89

16,200

26,502

-

-

5,234

5,234

10,213

89

10,966

21,268

8,526

74

9,156

17,756

₩

₩

₩

₩

₩

₩

$

$

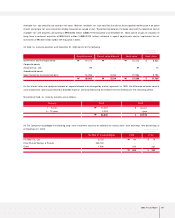

Maturity

2003Maturity 2003

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

1 ~ 5 years

6 ~ 10 years

24,269

2,233

26,502

20,261

1,864

22,125

₩

₩

$

$

Number of shares pledged 2003 2003

Korean won (in millions)

U.S. dollars (Note 2)

(in thousands)

Kia Steel Co., Ltd.

Kisan Mutual Saving’s & Finance

Other

8,755

306,160

1,500

84

-

320

404

70

-

267

337

₩

₩

$

$