Kia 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO NON-CONSOLIDATED FINANCIAL STATEMENTS

▶DECEMBER 31, 2003 AND 2002

78 Kia Motors Corporation

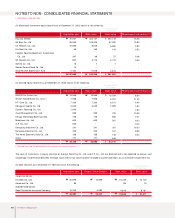

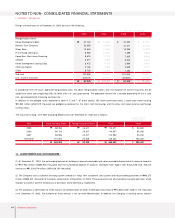

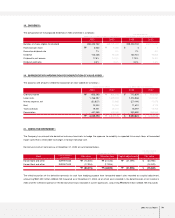

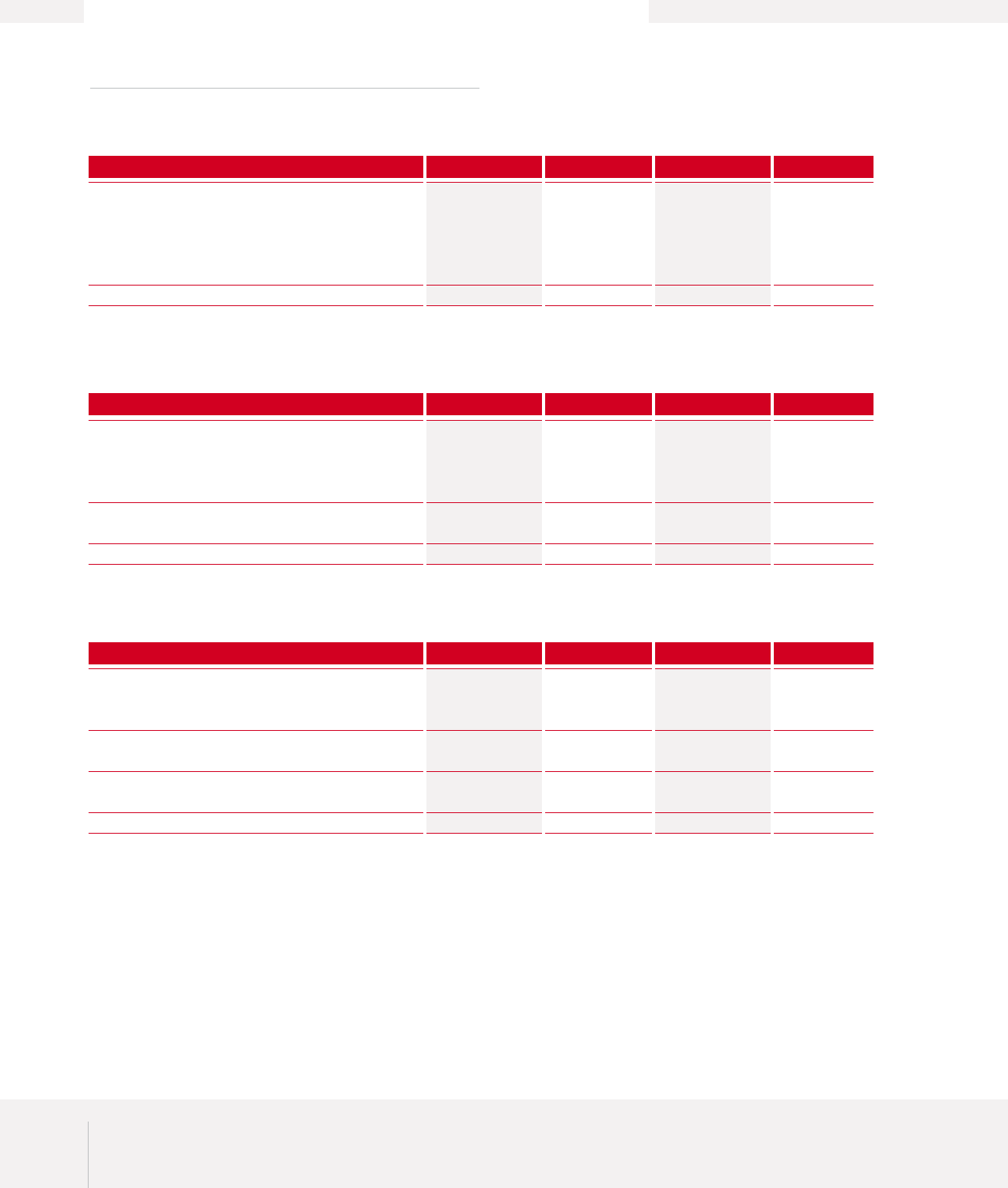

18. INCOM E TAX EXPENSE AND DEFERRED INCOM E TAX ASSETS :

Income tax expense in 2003 and 2002 is computed as follows :

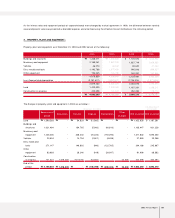

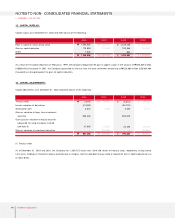

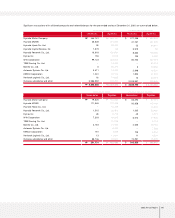

The difference between income before tax in financial accounting and taxable income pursuant to Corporate Income Tax Law of Korea is as

follows :

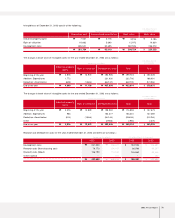

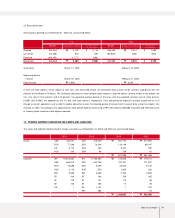

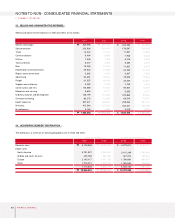

The changes in accumulated temporary difference in 2003 and 2002 and deferred income tax assets as of December 31, 2003 and 2002 are

computed as follows :

The accumulated temporary differences as of December 31, 2003 do not include the temporary differences of ₩272,036 million (US$227,113

thousand) for the gain on revaluation of land, which may not be disposed of in the near future.

When each temporary difference reverses in the future, it will result in a decrease (increase) of taxable income and income tax payable. Deferred

income tax assets are recognized only when it is probable that the differences will be realized in the future.

Effective tax rate of 27.5% including resident tax surcharges is applied to temporary differences expected to be realized after 2005 as such

change in corporate tax rate has been announced on December 30, 2003, which resulted in decrease in deferred tax assets by ₩15,567 million

(US$12,996 thousand).

2003 2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Income tax currently payable

Changes in deferred income taxes due to:

Temporary differences

Tax loss carry forward

Tax credit carry forward

Income tax expense

159,178

1,678

-

(12,680)

148,176

105,370

12,269

50,301

(8,009)

159,931

132,892

1,401

-

(10,586)

123,707

87,970

10,243

41,994

(6,686)

133,521

₩

₩

₩

₩

$

$

$

$

2003 2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Income before tax

Permanent differences

Temporary differences

Other adjustments

Tax loss carry forward

Taxable income

853,599

5,385

46,764

594

906,342

-

906,342

801,310

12,493

(39,267)

23,227

797,763

(169,363)

628,400

712,639

4,496

39,042

495

756,672

-

756,672

668,985

10,430

(32,783)

19,392

666,024

(141,396)

524,628

₩

₩

₩

₩

$

$

$

$

2003 2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2) (in thousands)

Accumulated temporary difference

Beginning of period, net

Changes in the current year, net

End of period, net

Statutory tax rate (% )

Tax credit carry forward

Deferred income tax assets

1,555,325

46,764

1,602,089

29.7/27.5

460,254

157,091

617,345

1,594,592

(39,267)

1,555,325

29.7

461,932

144,411

606,343

1,298,484

39,042

1,337,526

29.7/27.5

384,249

131,150

515,399

1,331,267

(32,783)

1,298,484

29.7

385,650

120,564

506,214

₩

₩

₩

₩

₩

₩

$

$

$

$