Kia 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 75

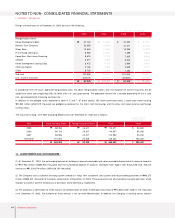

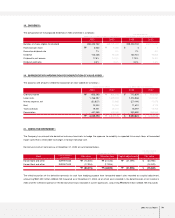

pertaining to the disputes with the Brazilian government and the Brazilian shareholders of Asia Motors Do Brazil S.A., which was established as a

joint venture by Asia Motors with a Brazilian investor, in Brazilian court. Also, in 2002, the Company brought the case to the International Court

of Arbitration to settle the disputes. The Company, stockholder of AMB, has already written off this investment of ₩14,057 million, and the

Company estimates that the above matter does not and will not affect the Company’s financial statements at this time.

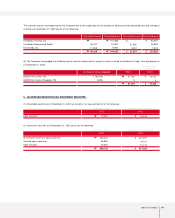

(4) The Company made an agreement with its overseas sales subsidiaries in Germany, Belgium, the United Kingdom and Austria for them to be

responsible for projected costs for dismantling and recycling vehicles sold in corresponding countries to comply with European Parliament

directive regarding End-of-Life vehicles (ELV).

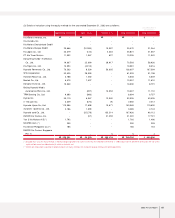

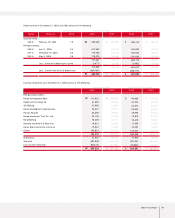

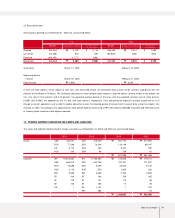

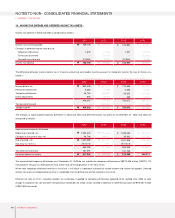

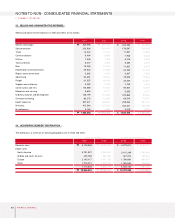

14. CAPITAL STOCK :

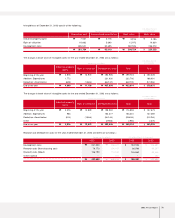

Capital stock as of December 31, 2003 and 2002 consist of the following :

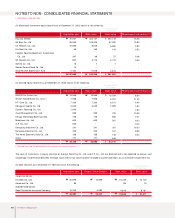

In accordance with the court-approved reorganization plan, on February 2, 1999 all issued shares of common stock, except those owned by

specific related persons, were reduced by a ratio of 10 to 1, and the shares owned by the specific related persons were extinguished.

Also, under the court-approved reorganization plan, on March 30, 1999, ₩5,482,181 million (US$ 4,576,875 thousand) of the Company’s

debt was forgiven, including its guaranteed obligations, and an additional ₩1,799,999 million (US$1,502,754 thousand) of its liabilities was

converted into capital stock for which 119,999,932 new shares were issued at ₩15,000 per share.

On December 7, 2000, ₩714 million (US$596 thousand) of a creditor’s claims in dispute was additionally determined by the court as the

Company’s reorganization claim and converted into capital stock for which 142,953 new shares were issued.

In accordance with the take-over contract with the Hyundai Motor Company, representing the Hyundai Motor Consortium, effective December

1, 1998, the Company issued new common stock of 172,431,118 shares amounting to ₩938,656 million (US$783,650 thousand) and the

Hyundai Motor Consortium acquired 153,000,000 shares amounting to ₩841,500 million (US$702,539 thousand) for 51 percent as of March

30, 1999.

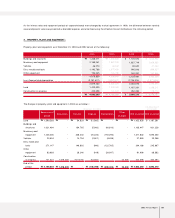

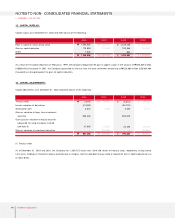

Financial institutions, with loans to the Company that had been forgiven or converted into the Company’s common stock, and Hyundai Motor

Consortium were granted rights to subscribe to the registered non-voting preferred stock with a par value of ₩5,000. On December 28, 1998,

the financial institutions acquired rights equal to 10 percent of the forgiven debt and liabilities converted into new capital stock. Also, on

December 28, 1998, the Hyundai Motor Consortium acquired rights up to the extent that the Consortium shall own up to 51 percent of all the

additional preferred shares to be issued. These pre-emptive rights can be exercised at once or several times in the fifth or tenth year from

December 28, 1999, the date the court finally approved the reorganization plan, and the Company shall pay the dividend equal to at least 2

percent for the preferred shares to be issued for the exercise of the rights. In 2003, the fifth year from the December 28, 1999, no pre-emptive

right was exercised. In addition, the Asia Motors-invested financial institutions and Hyundai Motor Consortium were granted pre-emptive

rights under the same conditions as described above.

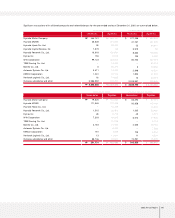

The Company completed stock retirement of 10 million treasury stock on July 2, 2003, which had been acquired for such retirement purpose

under the decision of the Board of Directors on May 9, 2003 and remaining shares of common stock are 359,730,455 shares. Due to this stock

retirement, the sum of face value of stock issued (₩1,798,652 million) differs from the capital stock amount.

AuthorizedYear U.S. dollars (Note 2)

(in thousands)

2003

2002

820,000,000 shares

820,000,000 shares

Issued

359,730,455 shares

369,730,455 shares

Par value

5,000

5,000

₩

₩

1,848,652

1,848,652

₩

₩

1,543,373

1,543,373

$

$

Korean won (in millions)