Kia 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 15

Lower Results in Spite of Best Efforts

Despite extraordinary efforts to cope with deteriorating domestic demand, the market slump exceeded

even the worst-case scenario. Domestic automobile sales for the year totaled a mere 319,795 units,

28% lower than the previous year’s figure. The Korea Automobile Manufacturers’ Association (KAMA)

reported Korea’s industry-wide demand dwindled i18.7% year on year in 2003. In addition to a general

economic downturn, poor passenger vehicle sales and production halts from protracted strikes at Kia

plants resulted in a reduction of Kia Motor’ domestic market share from 26.5% in 2002 to 23.8% a year

later.

Building M omentum for Long-term Competitiveness

Some very positive developments occurred as well, however. The launch of the Opirus and Cerato has

geared Kia Motors up for long-term competitiveness in the passenger vehicle market. The Opirus has

emerged solidly as Kia’s flagship model, and an aggressive marketing campaign has been undertaken to

broaden the Cerato’s hold within the target segment of the passenger vehicle market. Faced with severe

competition, Kia has focused on identifying prospective customers and winning them over with sales

promotions. The copany is also engaging in sports and cultural marketing as well as joint-marketing

campaigns with other popular brands to enhance the Kia image. Importantly, the customer database is

being used successfully to enhance sales effectiveness, while training programs and seminars have greatly

boosted professionalism of the sales personnel. The Customer Satisfaction training program has been

reinforced, and personalized servicing programs are offered to new customers. A computer telephony

interface system has been adopted to make customer service more responsive to requests, thus

significantly increasing customer satisfaction.

Gathering Forces for a New Grow th Surge

In 2004, Kia aims to sell 144,000 passenger vehicles, 177,000 RVs (SUVs, Mini-Vans, MPVs), and 94,000

commercial vehicles, 415,000 units in all, for a 27% , share of the domestic market estimated at

1,520,000 units by KAMA. To this end, The company will continue to strengthen competitiveness in the

passenger vehicle market with the Cerato, Opirus and Morning. The strong Kia brand in the RV segment

will be maintained, and the company’s number two position in Korea will be strengthened. Kia will also

develop new models that can compete effectively with surging imports of foreign cars into Korea.

▶The “X-Trek Tour to Experience Nature” program

was kicked off as a marketing tool as well as a way

to elevate the company’s environment-friendly

image.

▶▶ Press conference for the initial launch of the

Serato, as Kia takes aim at passenger car markets

at home and overseas in 2003.

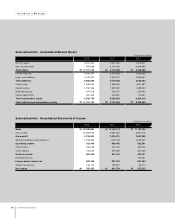

■Kia

■Others

∙

Source KAMA (Korea Automobile

Manufacturers Association)

Market Share

27.0%

26.5%

23.8%

01 02 03

Sales Volume

(units in thousands)

1,451

1,622

1,193

1,318

1,005

01 02 03

392

1,059

429 313