Kia 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 77

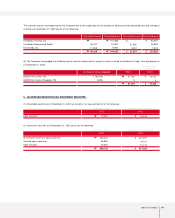

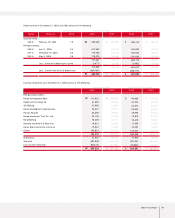

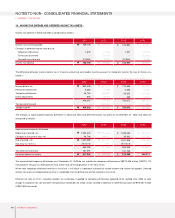

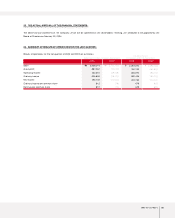

(2) Stock option cost

Stock options granted as of December 31, 2003 are summarized below.

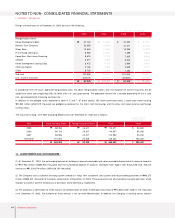

If all of the stock options, which require at least two-year continued service, are exercised treasury stock will be issued in accordance with the

decision of the Board of Directors. The Company calculates the total compensation expense using the option-pricing model. In the model, the

risk-free rate of 10.0 percent and 4.74 percent, the expected exercise period of 5.5 years and the expected variation rate of stock price of

0.8387 and 0.9504, are adopted for the 1st and 2nd stock options, respectively. Total compensation expense has been accounted for as a

charge to current operations and a credit to capital adjustments over the required period of service from the grant date using the straight-line

method. In 2003, the Company has accounted for stock option expense amounting to ₩1,064 millions (US$ 888 thousand) and 299,435 shares

of treasury stock issued for stock option exercised.

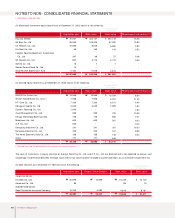

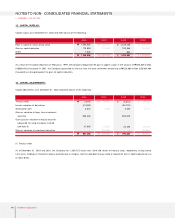

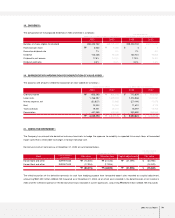

17. FOREIGN CURRENCY DENOM INATED ASSETS AND LIABILITIES :

The assets and liabilities denominated in foreign currencies as of December 31, 2003 and 2002 are summarized below.

Shares

1st 2nd

Granted

Cancelled

Exercised

Remaining

Grant date

Beginning date of

exercise

Exercise price

950,000

(15,000)

(299,435)

635,565

3,735

(59)

(1,177)

2,499

March 17, 2000

March 18, 2003

5,500

February 20, 2003

February 21, 2006

8,200

₩

₩

₩

3,118

(49)

(983)

2,086

$

$

Shares

695,000

(85,000)

-

610,000

2,974

(364)

-

2,610

₩

₩

₩

2,483

(304)

-

2,179

$

$

2003

Korean won (in millions)Foreign currencies (in thousands)

Assets

Liabilities

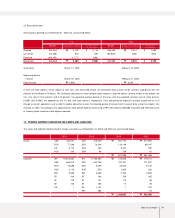

USD 336,251

EUR 77,299

CS 9,110

AUS 265

JPY 18,812,581

USD 666,019

EUR 16,588

AUS 2,119

DM 3,596

PD 329

SF 124

SK 100

CS 1

-

USD 310,639

EUR 70,264

AUS 265

DEM 96

JPY 11,764,694

USD 642,708

EUR 6,469

AUS 534

DM 4,463

PD 190

SF 101

SK 205

DK 1,131

FRF 488

402,762

116,149

8,437

238

527,586

210,626

797,757

24,924

1,900

2,763

700

119

17

1

-

1,038,807

₩

₩

₩

₩

372,896

88,347

180

62

461,485

119,161

771,507

8,134

362

2,869

365

88

28

192

94

902,800

₩

₩

₩

₩

2002 2003 2002

Korean won (in millions) U.S. dollars (Note 2)

(in thousands) Korean won (in millions) U.S. dollars (Note 2)

(in thousands)