Kia 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

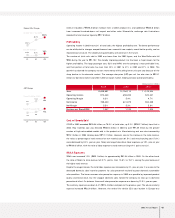

Sales

Kia sold 319,795 finished vehicles in Korea in 2003, down 28% from the previous year. However, exports

were up 19.8% to 538,902 units, for 858,697 total finished units sold, 4% lower than in 2002.

The Korean automobile industry suffered from sluggish domestic demand as a result of a protracted

economic downturn. Extended strikes by workers and less industrial demand for passenger cars were the

principle reasons for the reduction in units produced and sold. Kia’s market share of the domestic

passenger car fell 2.7% points to 23.8% during 2003.

On the other hand, Kia retained the top share of the Korean RV (SUV/MPV collectively) market even

though the number of units sold was down 21% year on year. Performance was buoyed by the robust

sales of the Sorento, Carens and X-Trek lines.

Despite the poor domestic sales, the export volume reached 538,902 units, or 19.8% higher than in

2002. Of these growing exports, 156,675 units were shipped to Europe, which represented 29.2% of

total exports in 2003, nearly 7% points higher than in 2002. As the result, Europe has quickly become

the company’s second largest export market.

Revenue in 2003 totaled just under ₩12.84 trillion, a 5.6% year-on-year rise that reflects an adjustment

for vendor sales of goods to be repurchased post-manufacture. The domestic market represented 40% of

the total revenue, and the remaining 60% was from overseas. The ₩618.8 billion growth in total

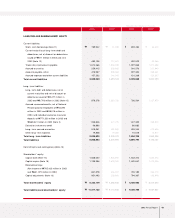

Sales (Units)

Domestic

Export

Sales (KRW in millions)

Domestic

Export

Cost of Sales (KRW in millions)

Cost of Sales Ratio

2003

858,697

319,795

538,902

12,839,881

5,126,358

7,713,523

10,084,078

78.5%

894,268

444,444

449,824

12,158,113

6,304,394

5,853,719

9,581,392

78.8%

899,788

411,321

488,467

11,129,204

5,146,620

5,982,584

8,531,616

76.7%

2002 2001

Management’s Discussion & Analysis

42 Kia Motors Corporation

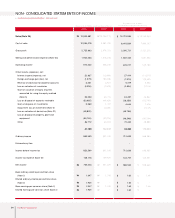

Export Breakdown by Region

(Based on Number of Shipment Units)

Export Shipment

(Units)

538,902 Units

02

9.4%

7.7%

5.5%

29.2%

48.2%

03

* KD Shipments Excluded * * Local Production Included

U.S

Europe*

China* *

2003

229,426

156,675

55,074

222,872

98,665

22,536

233,008

100,499

14,587

2.9%

58.8%

144.4%

2002 2001 Growth (2003-2002)

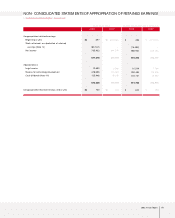

Sales

(KRW in Billions)

11,129.2

5,146.6

5,982.6

12,158.1

6,304.4

5,853.7

12,839.9

5,126.4

7,713.5

01 02 03

RV Sales

(KRW in Billions)

4,259

2,064

2,195

6,060

3,190

2,870

6,648

2,625

4,023

01 02 03

■Domestic

■Export

■Domestic

■Export

Asia / Pacific

Mid East / Africa

Latin America

Europe

N. America

449,824 Units

55.2%

21.9%

7.2%

8.1%

7.6%